- The US economy is doing well as more people are being paid.

- Recession worries might go down after the upbeat US jobs data.

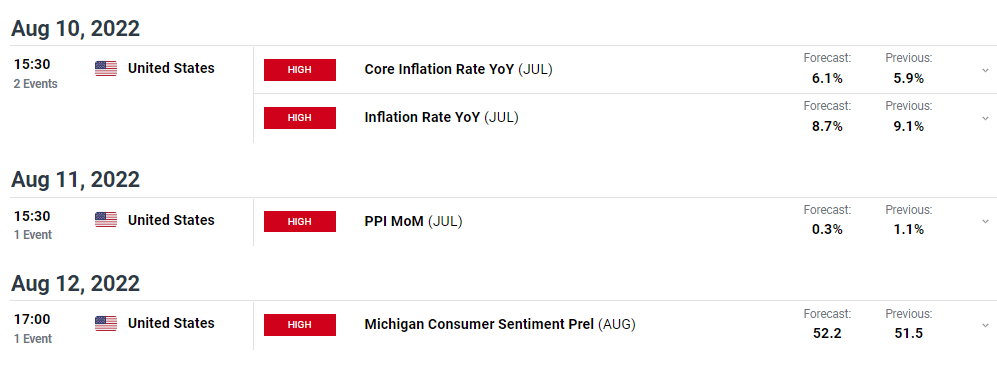

- Investors are awaiting the all-important inflation report from the US.

The weekly USD/CHF forecast is bullish as the dollar rally might continue if inflation in the US goes up. Such an occurrence would make for a more aggressive Federal Reserve.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Ups and downs of USD/CHF

According to the Labor Department’s employment report, the US economy added 528,000 jobs, more than double the 250,000 projected. At the same time, wage inflation remained high, and the participation rate decreased slightly.

“The payrolls number are wonderful from a demand standpoint. More people being paid is great for the economy,” said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder in New York.

“The employment data raises the prospect of a soft landing,” Keator said, adding that Fed Chair Jerome Powell has “pointed to the fact that a strong labor market has not historically accompanied recessions.”

The dollar index was last up 0.8 percent at 106.57, albeit it is still below its mid-July peak. Just before the US Labor Department’s employment report was announced, it was up roughly 0.2 percent. For the week, the index increased by around 0.6 percent.

Next week’s key events for USD/CHF

Investors will be receiving US inflation data next week. Expectations that the central bank will be able to cease raising rates early next year could be further dampened by indications that inflation is still robust despite a recent decline in commodity prices and tighter monetary policy.

“We’re at the point where consumer price data has reached a Super Bowl level of importance,” said Michael Antonelli, managing director and market strategist at Baird. “It gives us some indication of what the Fed and we are facing.”

USD/CHF weekly technical outlook: Bulls taking over inside the bearish wedge

-Are you looking for the best CFD broker? Check our detailed guide-

A break above the 22-SMA would show bulls taking over, and they might attempt to break out of the wedge pattern. If they do, the price might retest key resistance at 0.98824.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.