The US dollar is looking for a new direction after the Trump Dump. What’s next? Here is the view from Goldman Sachs:

Here is their view, courtesy of eFXnews:

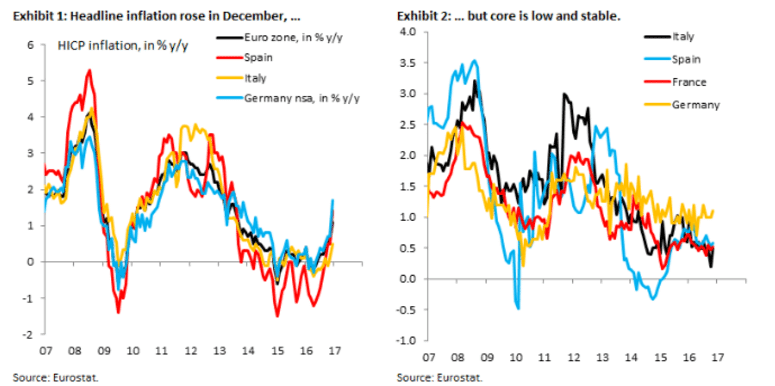

The ECB’s already-low forecast of 1.1 percent for core HICP this year is subject to downside risk. This analysis for core is compatible with our Rates strategists’ view of long Euro zone breakeven inflation as a 2017 Top Trade, given that the dynamics of headline and core inflation are different. Their trade aims to capitalize on a normalization of an “excessive” deflation risk premium, which may also lead to a rebuilding of term premia in nominal European government bonds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

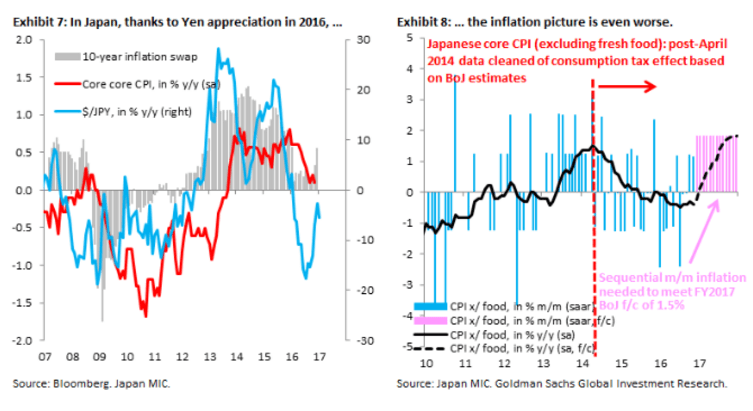

The same downside risk exists in Japan, where a large rebound in core inflation is needed for the BoJ to meet its forecast of 1.5 percent in FY2017, especially given that the appreciation of the Yen over the past year is only now feeding into the data. Special factors – large amounts of slack and periphery structural reforms in the Euro zone and entrenched low inflation expectations in Japan – will keep underlying inflation low in both places, so that further ECB tapering or a hike in the 10-year yield target from the BoJ are unlikely this year.

The “global reflation” theme has therefore drowned out what in reality are increasingly divergent fundamentals in the G10, so that what markets are calling “global reflation” is really a strengthening of the divergence theme that will ultimately drive the Dollar stronger.