The US dollar is on a roll, and not only against the Draghi-dragged euro. The greenback is rising across the board and one of the main reasons is the upcoming nomination of a Fed Chair. We do not have a definite name just yet, but there are reasons to suspect it will be John Taylor.

Taylor is a hawk beloved by Republicans and one of the two final candidates. The other one is Governor Jerome Powell. What we do know is that current Fed Chair Janet Yellen is on her way out. Yellen is the most dovish of those three.

So why Taylor and not Powell? The Standford University Professor made a public appearance overnight and he provided wording that President Donald Trump will certainly like. Taylor said the slow growth that the US experienced after the economic crisis is a result of the economic policy.

Who was the president after the crisis? Barrack Obama. If there is one consistent line in Trump’s policies, is that he is trying to dismantle anything his predecessor did. Blaming Obama makes Taylor more likable. And Trump also likes loyalty.

So if Taylor is nominated, he will likely be confirmed: he has the credentials, and this could raise expectations for rapid interest rate rises, thus boosting the dollar.

Dollar is rising

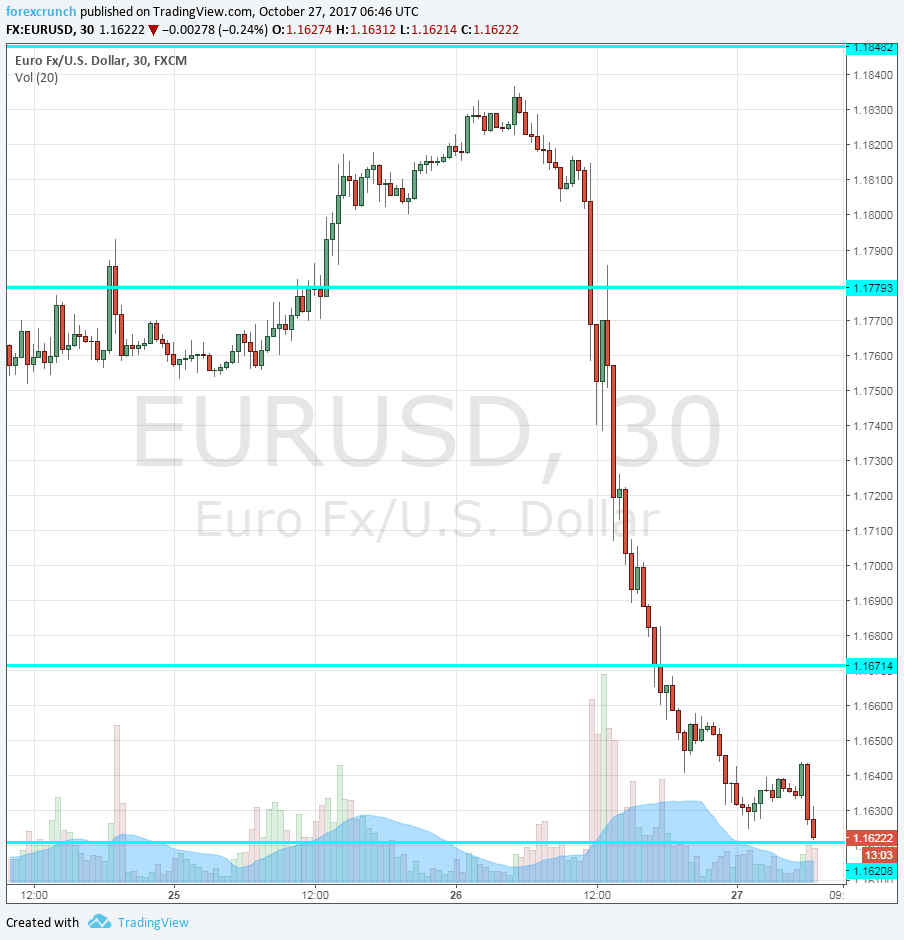

- EUR/USD is already down to low support at 1.1620, the 2016 high now works as a line of support. The euro has its own troubles: the ECB tapered bond-buying, but did not set an end date. The doves at the ECB won over the hawks.

- GBP/USD is down to 1.31. The pound actually received a dose of good news with better-than-expected growth. It initially rallied, but the expectations about the Fed Chair sent it down.

- USD/JPY is around 114.30, challenging the highs. The cycle high is 114.50 and it will be a tough nut to crack.

- USD/CAD continues its journey north. The Bank of Canada signaled a long pause in rate rises and a cautious approach. The pair is already at 1.2880, some 250 pips above the levels before the BOC decision.

- AUD/USD is down to 0.7640. The Australian dollar suffered from a political crisis in Australia but the bigger driver is the poor CPI figure released earlier this week.

All in all, the dollar is rallying against vulnerable currencies such as the euro, the Aussie and the loonie. The dollar is rising against stable currencies such as the yen. And the dollar is also beating currencies that have reasons to rise, such as the pound. Will this continue?

Here is how the dollar rally looks on the EUR/USD chart. The pair is more than 200 off the highs of the week. More: How low can EUR/USD go after the ECB decision? 3 views