The US dollar is suffering under President Trump, contrary to its rally under President-Elect Trump. What’s next?

Here is their view, courtesy of eFXnews:

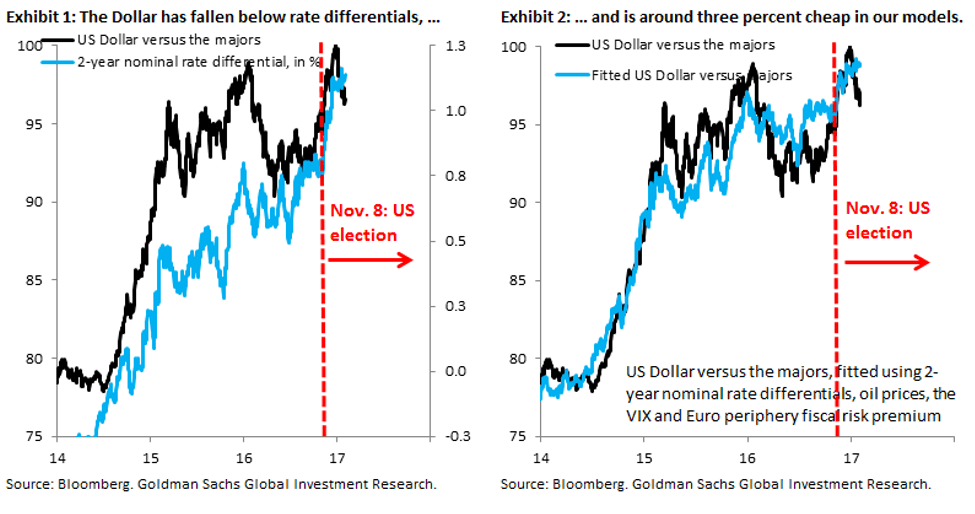

The Dollar is falling, shaking the conviction level of Dollar bulls. What is notable about this fall is that it coincides with broadly stable nominal rate differentials, in line with front-end market pricing for Fed hikes that is roughly unchanged since the start of 2017 , with about 125 bps priced through end-2019. As we have emphasized , rate differentials are by far the most important driver of the Dollar, so this divergence is potentially alarming.

We examines why the Dollar is falling. Most hypotheses, like better global growth or a US inflation overshoot, don’t explain why nominal and real rate differentials are so stable, even as the currency has fallen.

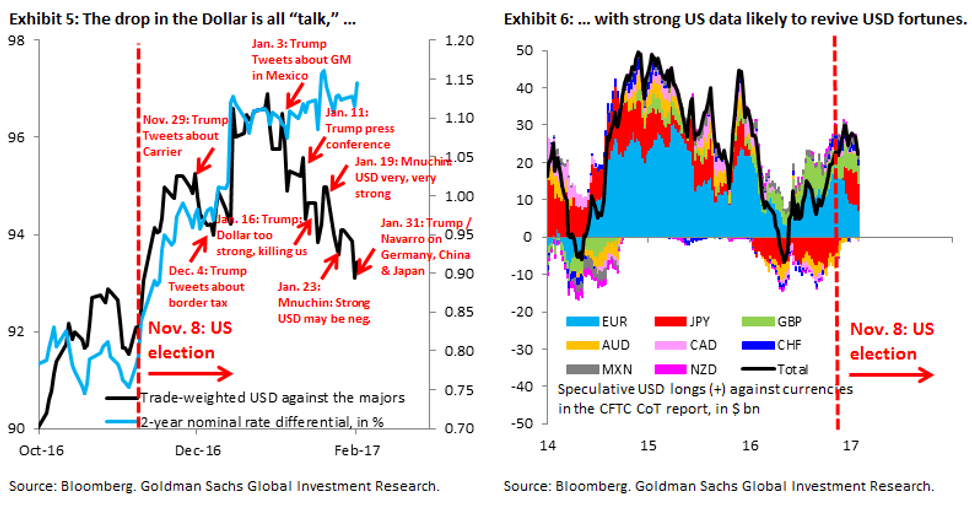

We believe the principal reason for the divergence is “Dollar down” rhetoric from the new administration. The underlying driver of this decoupling is therefore very different from the previous 2016 episode and we doubt it holds much relevance.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

We would say two things. First, we think the “Dollar down” rhetoric says more about the constraints facing President Trump, rather than likely outcomes. After all, a policy mix that combines ï¬scal stimulus and protectionism is hard to reconcile with a weaker currency, even if that is what the new administration wants. Second, speculative Dollar longs are more modest than they were a year ago, in particular where EUR/$ is concerned.

The fundamentals ï¬rmly favor Dollar up. The market just has to get used to the new administration and good data – including strong payrolls tomorrow – should help with that….

The last episode when USD diverged meaningfully below rate differentials began a year ago, when market fears over a large RMB devaluation were building. That episode lasted over six months, ending with the Nov. 8 election. The current episode of USD Weakness should be shorter, with a good run for US data – our expectation – the tie breaker.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.