After Yellen’s recent testimony, chances of a rate hike have risen to near 100%. The last opportunity to hint about further action comes from the FOMC meeting minutes:

Here is their view, courtesy of eFXnews:

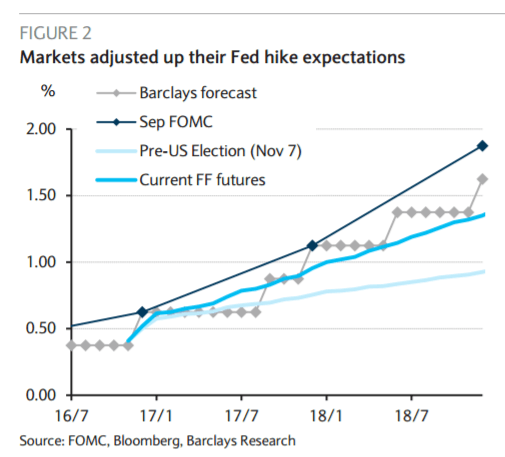

The USD has had a remarkable couple of weeks given the re-pricing of Fed expectations for next month (now 90%+ probability of a hike according to fed funds futures) along with a steeper path for hikes in the year to come (Figure 2). Although we agree that the potential for inflation to pick up is real, expectations regarding the path for monetary policy have moved in line with our expectation.

On the other hand, we think that the second leg of the USD rally needs to be confirmed by real policy plans, something that we have not seen so far. In this regard, the USD will be reactive to nominations on the new cabinet that could shape the outlook for fiscal, trade, security and immigration policy for the next few years.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

The only important development aside from politics is the publication of the minutes of the FOMC meeting. As was widely expected, the November FOMC meeting was uneventful. Heading into the meeting, we felt the Fed had two main goals: to keep expectations centered on a December rate hike, while maintaining flexibility to delay action, should events in the next two months not materialize as expected. We believe that the Fed achieved these goals. Although a few members likely called for a November rate hike, we think most members were likely comfortable waiting for the December meeting, given the proximity of the US election. We look to the minutes for the change in forecast that underpinned the FOMC’s modest upgrading of the inflation outlook.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.