In our FED preview, we laid out three scenarios, only one USD positive. Here is the view from Barclays, which offers selling the fact:

Here is their view, courtesy of eFXnews:

Wednesday’s FOMC meeting is unlikely to provide a catalyst for further USD strength and may instead encourage profit taking on long USD positions as we approach year-end, particularly in currency pairs where the USD is most expensive.

A 25bp hike is widely expected by both interest rate markets (23bp of hikes priced) and analysts, including ourselves. Furthermore, fed funds futures imply a policy path for the coming year that is broadly consistent with the median FOMC participant September forecast (implied year-end 2017 fed funds rate of 0.96% versus median FOMC forecast of 1.1%). In its forward guidance, we expect Chair Yellen to balance the decision to raise rates with a dovish message of a shallow expected policy path and a willingness to test the potential benefits of running a “high pressure” economy.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Positioning, valuation and seasonal factors also support some near-term USD consolidation. Our FX flow data are consistent with indications from FX futures markets, which suggest that speculative investors remain significantly long the USD. With USD appreciation of about 4% since early October on a trade-weighted basis, to a point where we estimate the USD is close to 20% expensive, we think there is strong incentive for these investors to unwind some of their positions as year-end approaches.

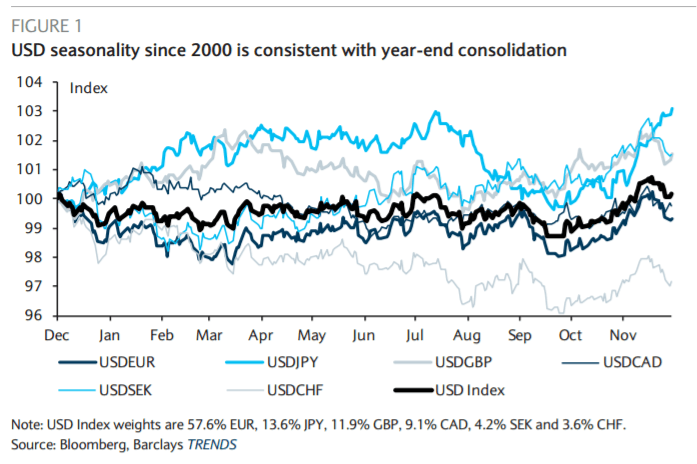

Seasonal considerations also suggest the USD, on an index basis, tends to weaken into year-end.