Today, it’s going to be big day for the markets as the FED may deliver higher rates. Technically USD may see higher prices and stocks as well based on the current intraday patterns on USD Index and E-mini S&P500.

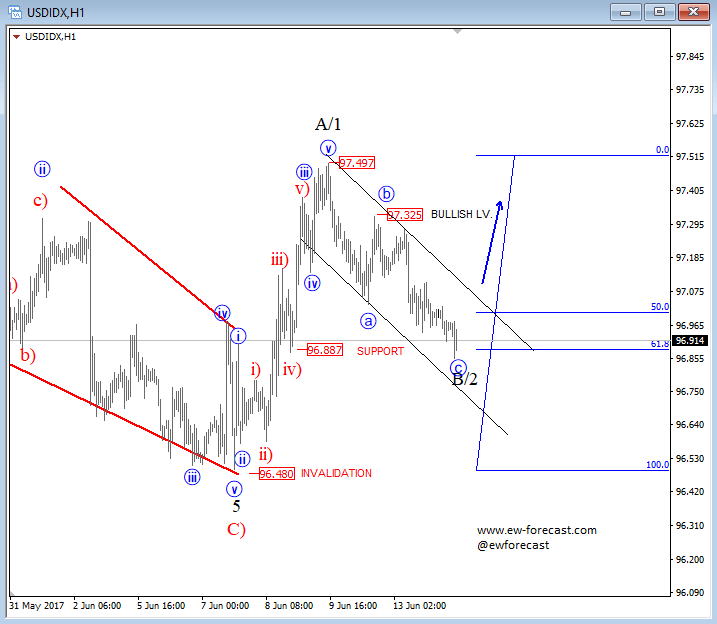

On the USD Index we are observing a bullish pattern after the five wave rally last week from 96.48, followed by a three wave set-back from 97.50. It can be wave B/2 so ideally the market will turn up today, but because of the FED and different possible scenarios we want to see a break above 97.32 to confirm a third leg of recovery.

USD Index, 1H

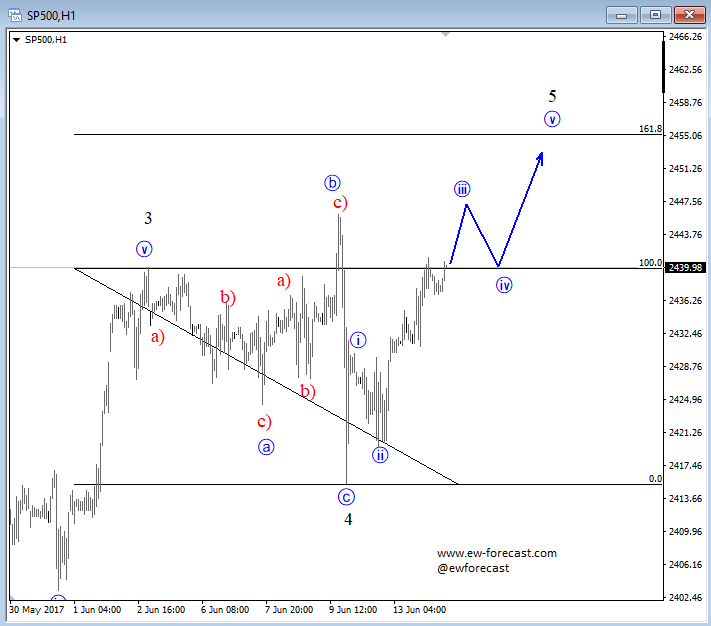

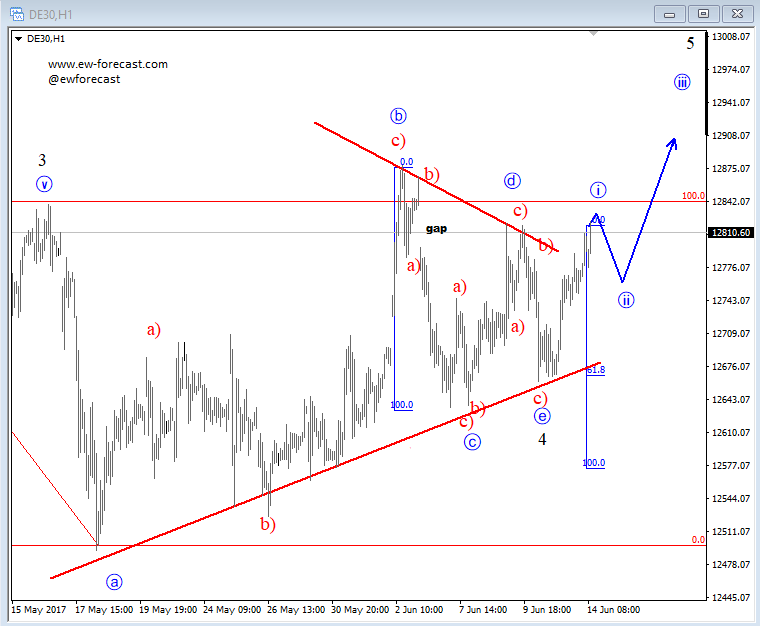

On stocks, we are looking higher as both S&P500 and DAX are showing a completed contra-trend moves in wave four. S&P500 made a flat and DAX a triangle, so the markets can continue higher to 2450/60 and 12950/13000.

S&P500, 1H

German Dax, 1H