Key news updates for USD/JPY

Updates:

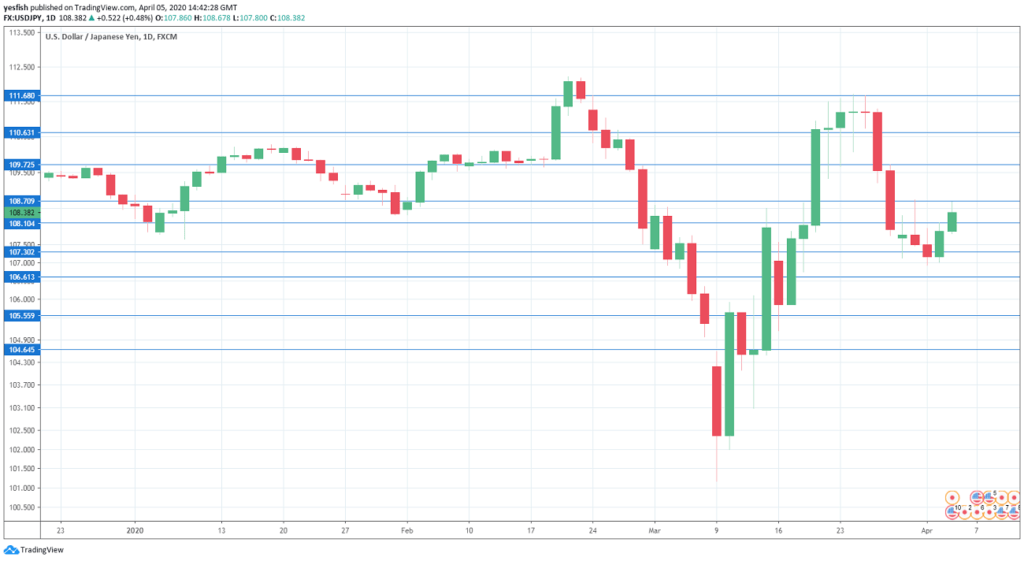

USD/JPY Technical Analysis

We start with resistance at 111.69.

110.62 is next.

109.73 is protecting the 110 level, which has psychological significance.

108.70 (mentioned last week) is an immediate support level.

108.10 has switched to a support role after USD/JPY broke above it last week.