Dollar/yen jumped 1.6% last week, its highest weekly gain since July 2018. Investors will be keeping an eye on key Japanese consumer data, with the release of Tokyo CPI and retail sales.

Japanese GDP declined by 1.6% in the fourth quarter, a sharper drop than the forecast of -1.0%. This marked the first decline in five quarters. Despite the weak economic conditions, analysts don’t expect the BoJ to step in with any easing measures.

The Federal Reserve minutes indicated that policymakers were cautiously optimistic about maintaining rate levels. However, policymakers expressed concern about coronavirus outbreak, stating that “the threat of the coronavirus, in addition to its human toll, had emerged as a new risk to the global growth outlook, which participants agreed warranted close watching.” Policymakers also noted that the outbreak has dampened investor sentiment. This warning from the Fed underscores the threat that coronavirus poses to the global economy. There was some disappointing news on the manufacturing front, as manufacturing PMI came in at 50.8, which indicates stagnation in the manufacturing sector. This was shy of the estimate of 51.5 points.

Key news updates for USD/JPY

Updates:

USD/JPY Technical Analysis

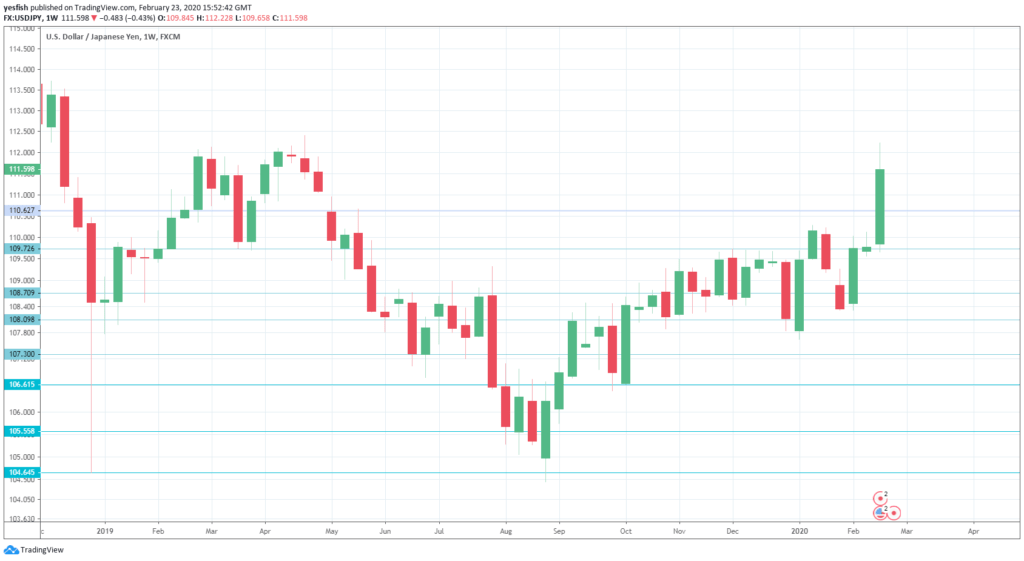

We start with resistance at 114.20.

113.15 was a swing high back in July.

112.25 has held in resistance since December 2018.

111.69 was tested last week for the first time since April 2019.

110.62 has switched to support after strong gains by USD/JPY last week.

109.73 is next.

108.70 (mentioned last week) is providing support.

108.10 last saw action in the first week in January. It is the final support line for now.

USD/JPY Sentiment

I remain bullish on USD/JPY

The China coronavirus continues to take its toll on Japan’s fragile economy. The outbreak has hurt tourism, services and other sectors of the economy. This has spelled trouble for the Japanese yen, as USD/JPY closes in on the 112 level.