Key news updates for USD/JPY

Updates:

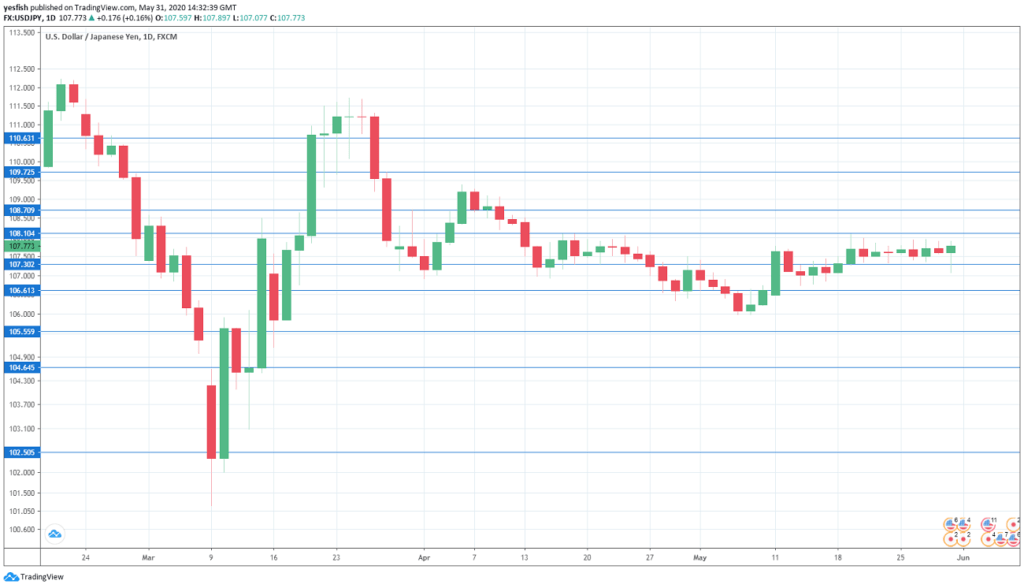

USD/JPY Technical Analysis

We start with resistance at 110.62.

109.73 is protecting the 110 level, which has psychological significance.

108.70 (mentioned last week) is next.

108.10 has held in resistance since mid-March.