Key news updates for USD/JPY

Updates:

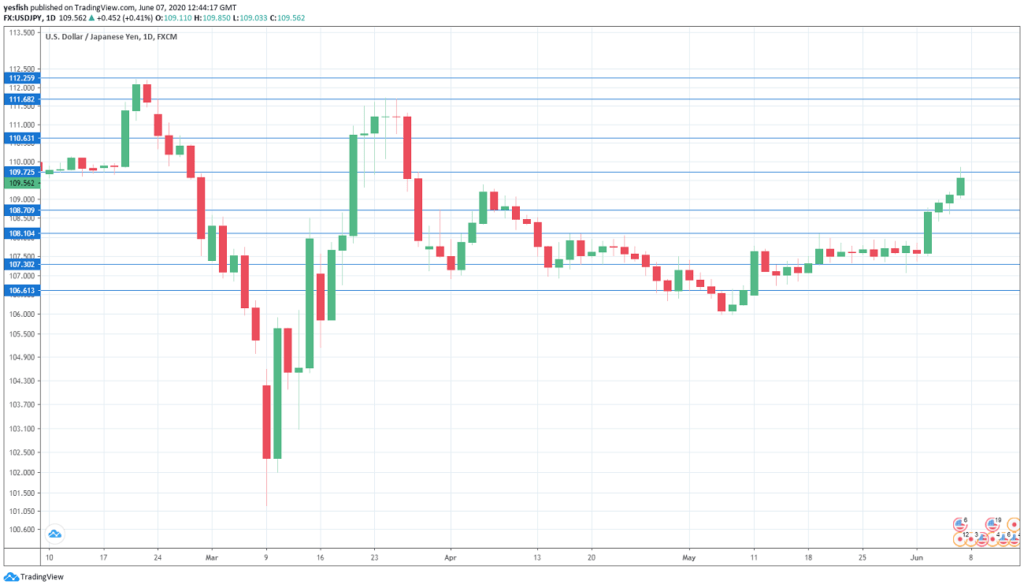

USD/JPY Technical Analysis

With USD/JPY posting strong gains last week, we start with resistance at higher levels:

113.15 was a swing high back in July.

112.25 has held in resistance since December 2018.

111.69 (mentioned last week) is next.

110.62 switched to resistance in late March, when USD/JPY dropped sharply.

109.73 is protecting the 110 level, which has psychological significance.

108.70 is providing support.

108.10 last saw action in the first week in January.

107.30 has some breathing room after USD/JPY posted strong gains last week.

106.61 is the final support level for now.