Dollar/yen is falling down alongside global stocks and also commodities. The weak Japanese GDP actually pushed the yen higher. Deliberations around tax cuts in the US are somewhat stuck and this isn’t helpful for the greenback. Worries about North Korean submarines boosted the yen. The upcoming week features Thanksgiving and also the Fed minutes.

USD/JPY fundamental movers

Fear is back

Is the “most hated stock market rally” coming to an end? In any case, markets did not fall for quite some time and this is becoming a driver against dollar/yen. When stocks and commodities fall, money flows away from commodity currencies and into the yen. This time, also the euro enjoys this rise.

Japanese GDP growth came out at 0.3%, weaker than expected, but still the longest streak of growth in a decade.

In the US, Republicans tried to push a significant change to healthcare into the tax bill, making the passage of the bill more complicated. The reports about a new probe by the Mueller team into the Trump campaign has also taken its toll on the greenback.

US inflation is not going anywhere fast. While it advanced more than expected and the inflation numbers were OK, it did little to inspire the markets.

Thanksgiving, Fed minutes and durables

A quieter week in terms of calendar events awaits traders. The Thanksgiving holiday on Thursday can slow down the whole week. However, Wednesday’s Fed minutes could shed some light on what Fed officials think of inflation. The most serious indicator is the durable goods orders figure. In Japan, only the trade balance is worth mentioning, but it rarely moves the yen.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

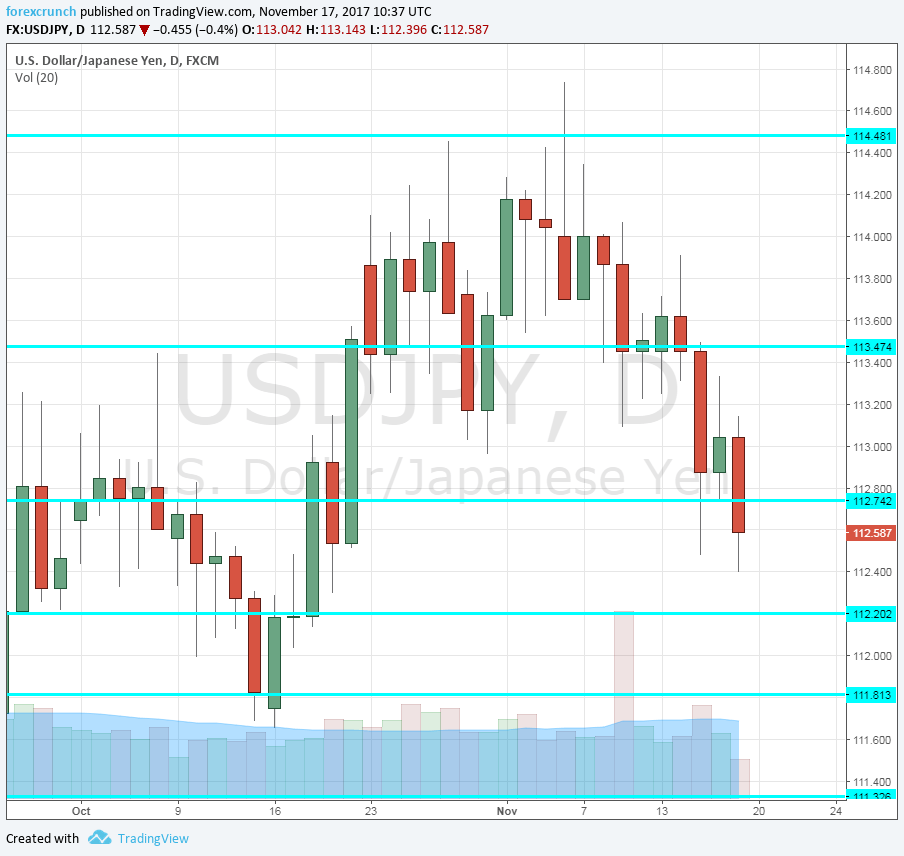

115.35 is an old line that served as support when the pair traded on higher ground. 114.50 is the cycle high last seen in early July. The pair got close to that level.

113.50 was a temporary line of resistance on the way up in July. 113.70 was a separator of ranges in June.

112.20 used to be important in the past. It is closely followed by 111.80, which capped the pair in May. The swing high of early September at 111.30 serves as another point of interest.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance.

USD/JPY Daily Chart

USD/JPY Sentiment

I remain bearish on USD/JPY

While the “fear factor” may be exaggerated, the US dollar seems to have run its course. The path of least resistance seems to be to the downside.

Here are all the four reasons for the downfall.

Our latest podcast is titled Pound problems and real raises

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!