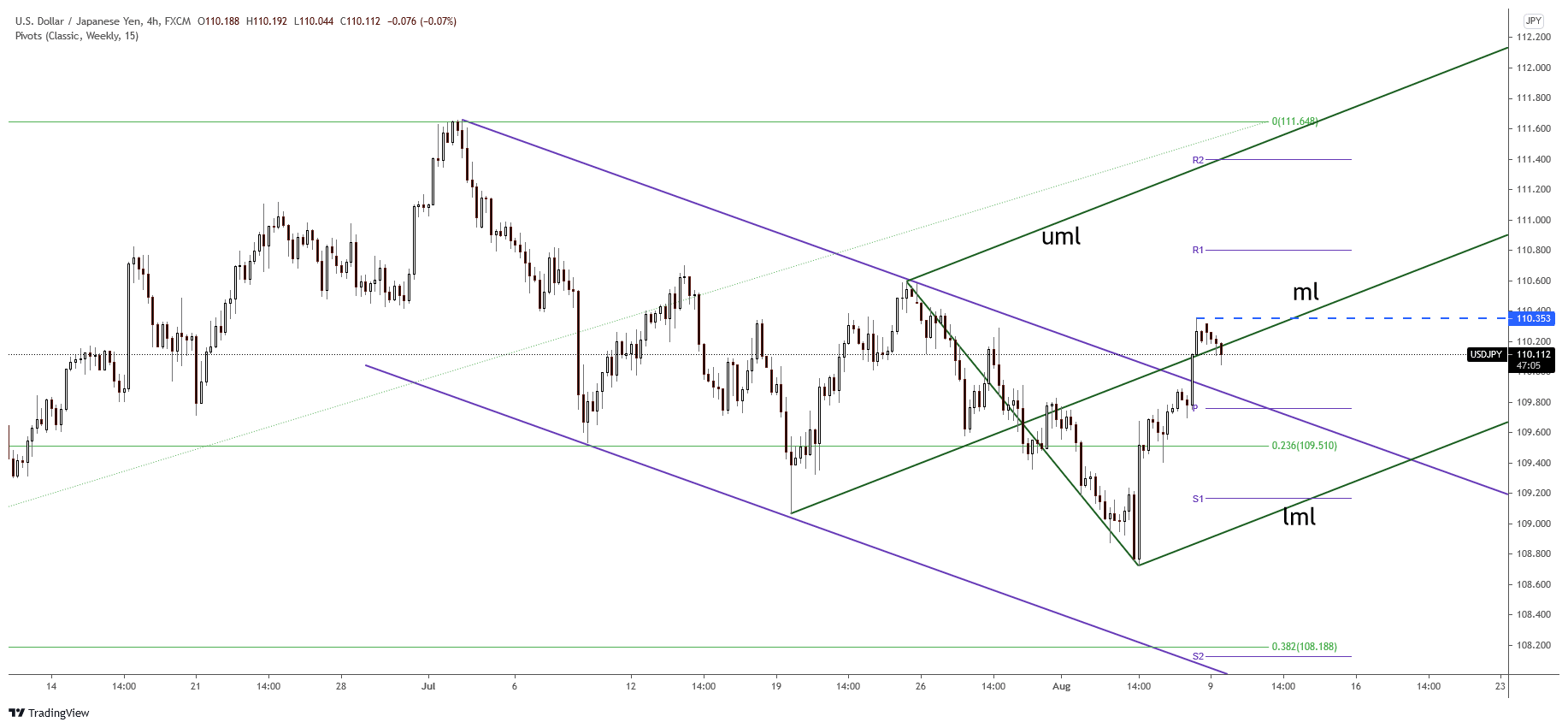

- USD/JPY could still increase despite the current drop caused by the DXY and JP225 decline.

- The pair could resume its growth if it makes a new higher high and if it comes back above the ascending pitchfork’s median line (ML).

- The upside scenario could be invalidated only by a valid breakdown through the lower median line (LML).

The USD/JPY price is trading in the red at 110.08 after failing to resume its upwards movement. The pair has slipped lower as the Dollar Index and the JP225 are trading in the red right now. Still, the current decline could be only temporary. DXY could jump higher anytime if the US economic data came in better than expected during the week.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Also, the Nikkei (JP225) is traded below as strong dynamic resistance, so the pressure is still high in the short term. You should know that the Japanese Banks are closed in observance of Mountain Day.

Today, the pair could be moved by the FOMC Member Bostic, and FOMC Member Barkin remarks. Tomorrow, the Japanese Current Account, Economy Watchers, and the Bank Lending could bring some action.

The main event of this week is represented by the US inflation data release. The CPI and the Core CPI will be published on Wednesday. Most likely, USD/JPY will register sharp movements around these figures.

USD/JPY price technical analysis: Key levels to follow

The USD/JPY price dropped after reaching the 110.35 level. It’s located below the ascending pitchfork’s median line (ml). Staying below it may signal further decline towards the broken downtrend line and down to the 109.75 weekly pivot point.

–Are you interested to learn more about forex signals? Check our detailed guide-

Technically, a minor consolidation could bring us a new long opportunity. Now, we don’t have a great buying or selling opportunity. The USD/JPY pair has escaped from the down channel pattern signaling an upwards movement.

The pair could come back to test and retest the immediate support levels before jumping higher. USD/JPY has failed to stabilize under the 23.6% retracement level, signaling that the retreat is over.

Personally, I believe that only a downside breakout below the ascending pitchfork’s lower median line (LML) could invalidate the upside scenario. It could still increase as long as it stays above the broken downtrend line, channel’s resistance.

Coming back above the median line (ml) and making a new higher high to close above 110.35 may signal further upward movement.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.