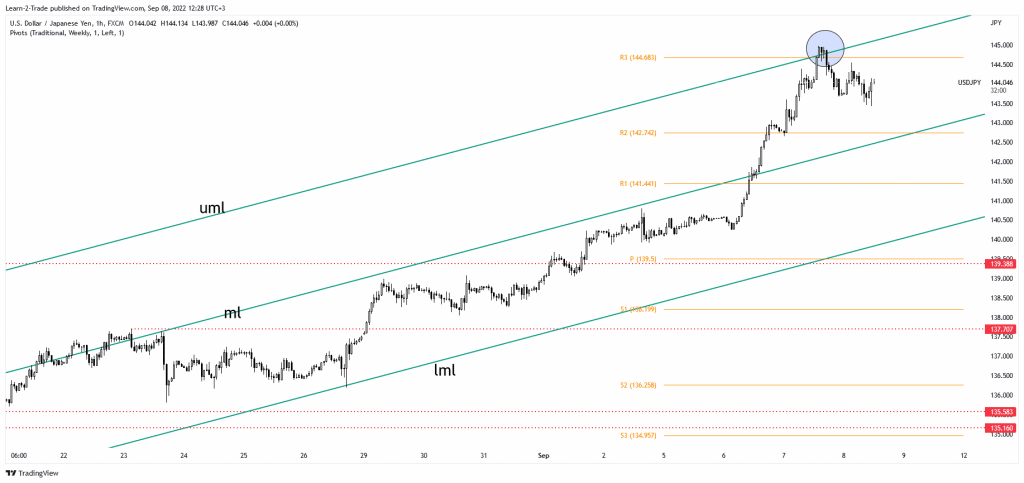

- The USD/JPY pair maintains a bullish bias despite the current sell-off.

- The correction was expected after failing to stay above the R3.

- Technically, the flag formation could bring an upside continuation.

The USD/JPY price dropped a little after its strong upwards movement. The pair is trading at 144.07 level at the time of writing.

–Are you interested in learning more about forex signals? Check our detailed guide-

As expected, the price slipped lower after the BOC increased the Overnight Rate from 2.50% to 3.25%. Today, the Japanese economic data came in mixed. The Final GDP rose by 0.9% exceeding the 0.7% growth expected. The Final GDP Price Index registered a 0.3% drop versus a 0.4% drop estimated. The Current Account came in at -0.63T versus the 0.06T forecasted.

In comparison, Bank Lending reported 1.9% growth, matching expectations. Later, the US Unemployment Claims indicator is expected at 234K in the last week. In addition, Fed Chair Powell Speaks could bring more action.

Still, the ECB could shake the markets today as the monetary policy meeting represents a high-impact event. As you already know, the Main Refinancing Rate is expected at 1.25%. The Monetary Policy Statement and the ECB Press Conference could also impact the USD/JPY pair.

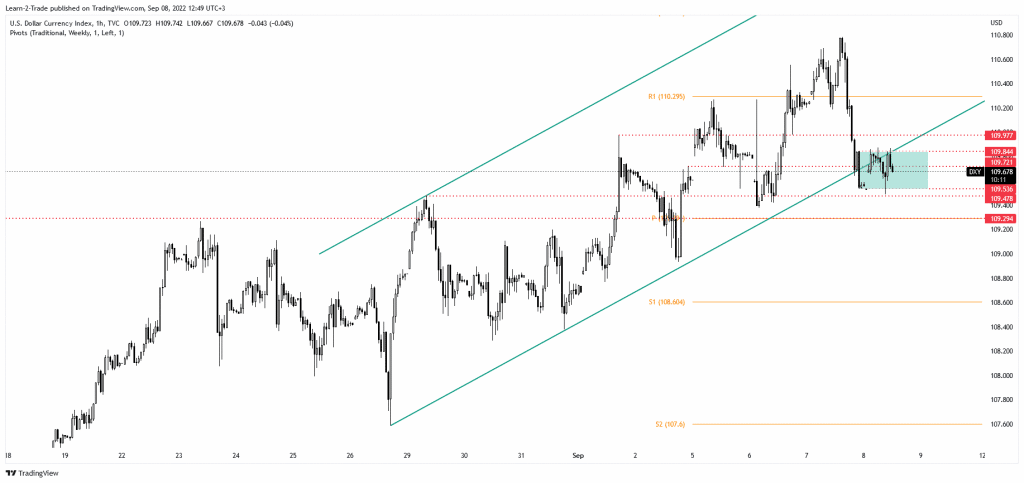

Dollar Index price technical analysis: Corrective phase

The DXY retraced its gains in the short term. It tested the broken ascending trendline and could return to the 109.53 static support. Despite the current sell-off, the bias remains bullish as long as it stays above the 109.47 and 109.29 levels.

USD/JPY price technical analysis: Confluence area

As you can see on the hourly chart, the USD/JPY pair registered a strong upwards movement. Technically, a temporary retreat was natural. The price jumped above the weekly R3 (144.68) and the upper median line (UML), but it has failed to stabilize above these upside obstacles signaling exhausted buyers.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Its false breakout through the confluence area triggered a sell-off. The price dropped, but this could represent a flag pattern that could initiate an upside continuation. It is preferable to wait for the pair to retest the median line (ml) and the 143.00 psychological level before finding new long opportunities.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.