Dollar/yen finally found its footing and began recovering. The USD enjoyed a potent mix of good data, positive comments from Fed officials and upcoming tax cuts. The yen did not manage to ride on fears from yet another North Korean missile test. Will it continue higher?

Update: The Senate approved the bill by 51 to 49.

USD/JPY fundamental movers

Everything in favor of the dollar

It began with the highest new home sales in a decade, continued with a similar record from consumer confidence and then we got GDP at 3.3% annualized for Q3: an upgrade and also a great number on its own.

Outgoing Fed Chair Janet Yellen was relatively upbeat about the economy, while incoming Chair Powell said that a rate hike in December is “coming together”. He also sent a message of continuation in his confirmation hearings.

The US Congress is advancing step by step and in a determined manner to pass significant tax cuts. While the average American will not enjoy it, nor will growth really rise, this is helpful to the US dollar. While there are doubts about the “trigger”, there is a good chance that it will pass.

North Korea tested yet another missile, this time with a potential capacity to reach the East Coast of the US. This worrying development did not rattle the yen for a change.

Full buildup to the NFP and some data from Japan

The first full week of December includes the ADP NFP, the ISM Non-Manufacturing PMI and they all lead to the Non-Farm Payrolls. The University of Michigan’s consumer confidence and factory orders are also worth mentioning. For a change, we will get a significant number from Japan: a revision of GDP.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

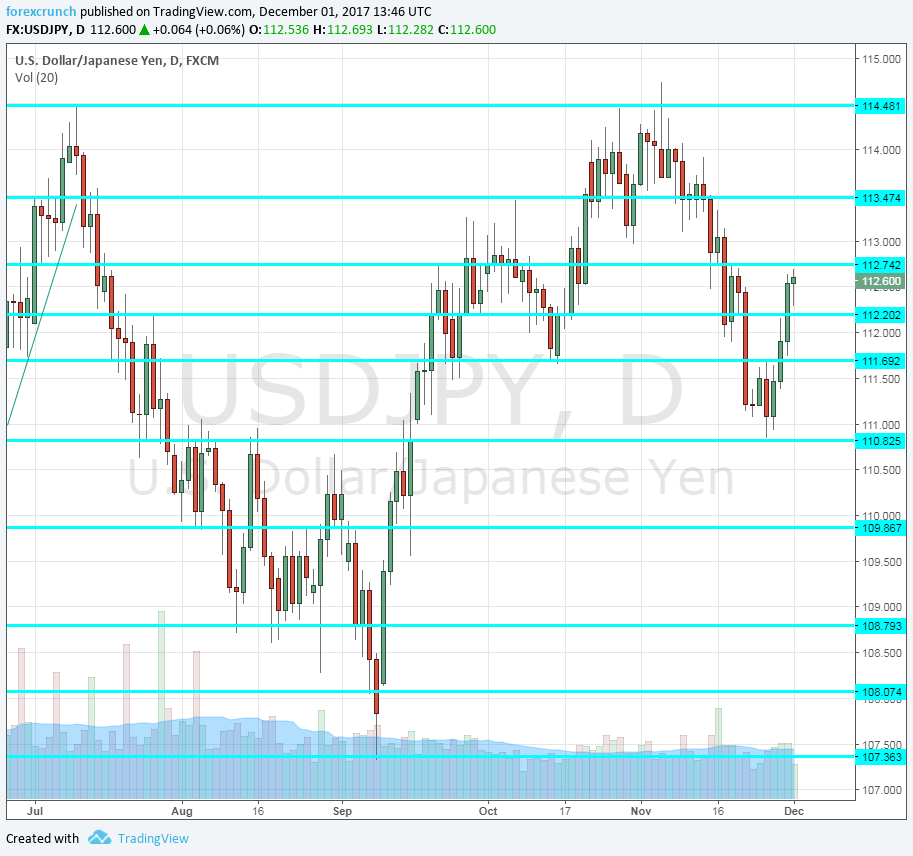

115.35 is an old line that served as support when the pair traded on higher ground. 114.50 is the cycle high last seen in early July. The pair got close to that level.

113.50 was a temporary line of resistance on the way up in July. 113.70 was a separator of ranges in June.

112.20 used to be important in the past. It is closely followed by 111.70, which provided support back in October. The round level of 111 worked as a cushion to the pair in November.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance.

USD/JPY Daily Chart

USD/JPY Sentiment

I am neutral on USD/JPY

Recent US economic data was just too good to ignore, and after the pair dropped it could stabilize around current levels. We may get some jitters from the Fed, so a full rally of the dollar is still unlikely.

Our latest podcast is titled A December to remember for EUR/USD

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!