- The USD/JPY pair performed well at the end of the week due to the good results in job creation in the United States.

- The USD/JPY pair exceeded the 110.00 Yen barrier.

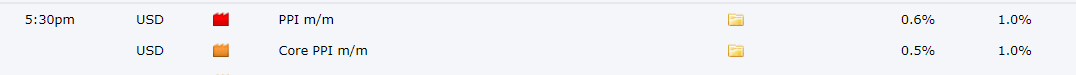

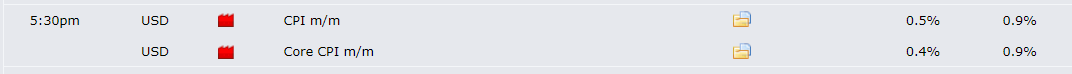

- For the next week, US CPI and PPI data can provide fresh impetus to the pair.

- In Japan, household spending fell more than expected.

In the second half of the week, the USD/JPY weekly trend analysis changed its trend and generated strong gains, especially after the good economic results presented in the US NFP report on Friday.

Job creation in July far exceeded expectations. A total of 943,000 new jobs were created, well above the 870,000 expected number. Additionally, the May and June corrections totaled 119,000 for a total of 1,062,000 new jobs.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Along the same lines, both the unemployment rate and annual wages improved their indicators, which gave a boost to the US economy and, in turn, boosted the USD/JPY pair.

The country’s unemployment rate fell to 5.4%, reducing this indicator by 0.5% from the 5.9% registered in June, much better than the 0.2% expected for this month. As for annual salaries, they improved by 4%, above the 3.7% increase in June. The underemployment rate also fell to 9.2% from 9.8% previously.

The pair responded immediately to the announcements and rose above the 110.00 barrier.

On behalf of the Japanese economy, spending is limited by restrictions due to new Covid-19 cases in the country. In this sense, spending decreased by 5.1% from June 2020 to June of this year, well below the 0.1% estimated.

Upcoming Events

The consumer price index (CPI) will be released on Wednesday, followed by PPI data on Thursday. The US CPI is expected to decline to 0.5% against June’s 0.9% figure. The Fed policy directly depends on it. The good results of these indexes will further strengthen the US dollar.

–Are you interested to learn more about forex signals? Check our detailed guide-

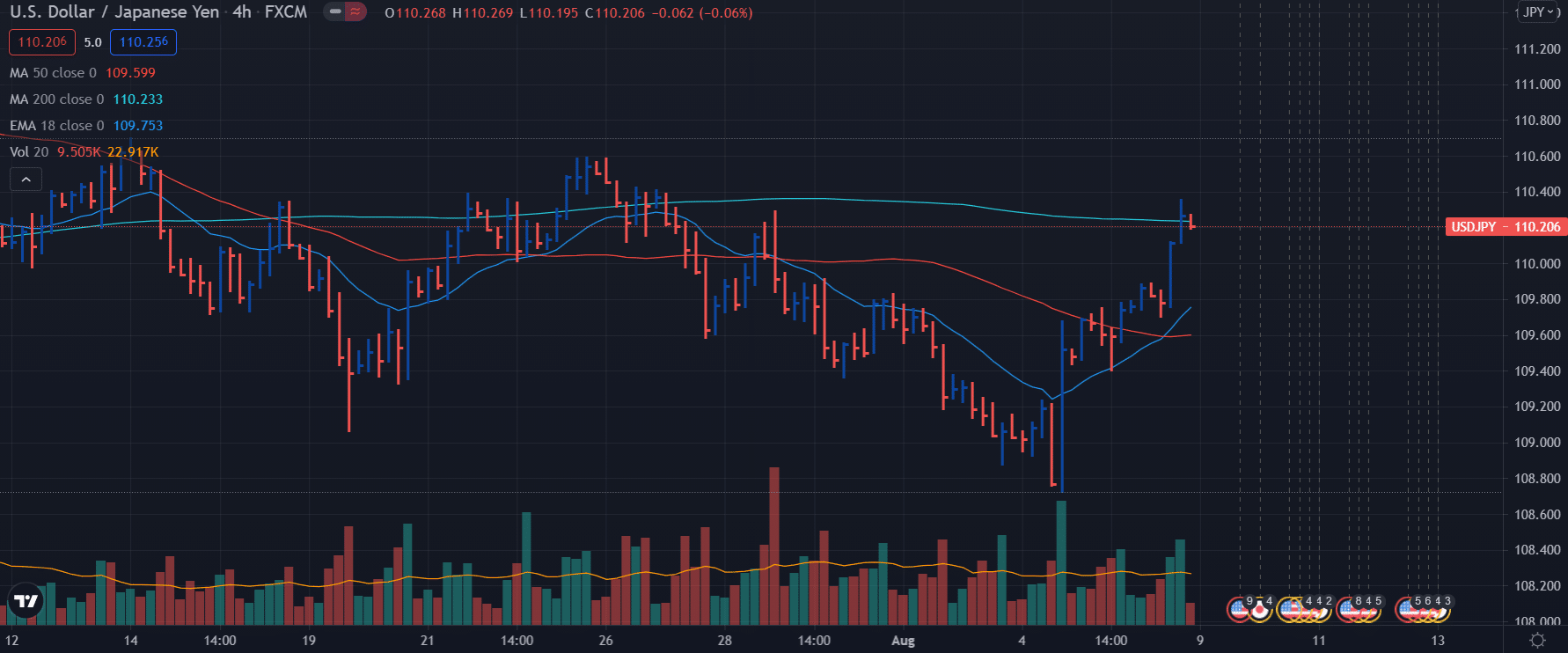

USD/JPY technical analysis: Bulls sustaining beyond 110.00

During the session on Friday, the USD/JPY surpassed the barrier of the 50-day moving average and the psychological barrier of 110.00. These levels now become support zones. The new resistance lines are 111.00 and 111.50. Above is the cap of March 2020 swing high (111.97 Yen).

USD/JPY weekly forecast: Sideways movements between 108.50 and 111.75

The current level of the market has been tested several times, and that presents strong resistance above 110.75. The market may try again to overcome the 110.75 barrier, but it can rebound and consolidate gains. So, the price may keep oscillating between 108.50 and 111.75 Yen.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.