- March retail sales in the United States were lower than expected.

- US Initial jobless benefit claims rose more than anticipated last week.

- According to analysts, Japan’s core consumer inflation likely held steady in March.

The USD/JPY weekly forecast is bullish as investors scramble for safety in the dollar amid signs of a declining economy.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

Ups and downs of USD/JPY

This week, the US delivered several significant economic indicators indicating an economic downturn.

March retail sales in the United States were lower than expected, suggesting the economy faltered. Given the deteriorating labor market, retail sales are projected to remain low.

Initial jobless benefit claims rose more than anticipated last week, indicating that the labor market was easing as rising interest rates dampened demand.

Additionally, producer prices decreased in March for the first time in over three years, and sticky services inflation decreased. Due to lower gas prices, consumer prices in the US hardly climbed in March.

According to the Federal Reserve’s March policy meeting minutes, the Federal Open Markets Committee expressed concern about the banking crisis.

These reports present a picture of a collapsing economy, prompting recession concerns.

There is widespread speculation that the Bank of Japan (BOJ) may modify or abandon its bond yield control policy. Ueda has, however, reiterated that it was reasonable to keep the current monetary easing in place, dimming hopes for a shift.

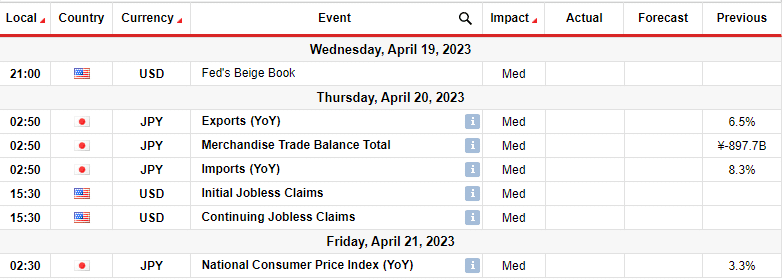

Next week’s key events for USD/JPY

Next week, investors will get to see the state of inflation in Japan. According to analysts, Japan’s core consumer inflation likely held steady in March.

Investors will also focus on the initial jobless claims report from the US that will give insight into the labor market.

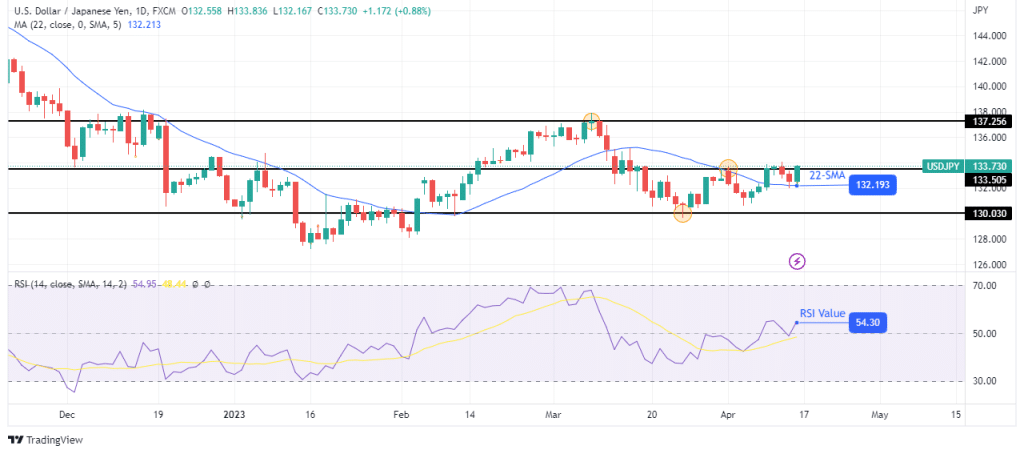

USD/JPY weekly technical forecast: Bulls heading for 137.25

The daily chart clearly shows a shift in sentiment in USD/JPY. Bears had control but only briefly, as the price failed to go below 130.03. At this point, bulls took over by breaking above the 22-SMA. The price broke above the SMA, retested it, and is now on the move higher. The RSI has also done the same thing at the 50-level.

–Are you interested to learn more about South African forex brokers? Check our detailed guide-

However, bulls must break above the 133.50 resistance for the bullish move to continue. Otherwise, we might get a consolidation below this level. However, the bullish bias is strong, and the next target for bulls is at the 137.25 resistance.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.