- USD/JPY closed the week with slight gains, looking for more losses in the coming week.

- The US dollar gained traction during the week as risk sentiment deteriorated amid rising Covid cases worldwide.

- The FOMC meeting minutes of July indicated a plan to taper the current QE by the end of the year.

- As indicated by the retail sales data, Japan’s economy is performing better while US consumer sentiment is on the backfoot.

- Technically, the pair has room to fall further.

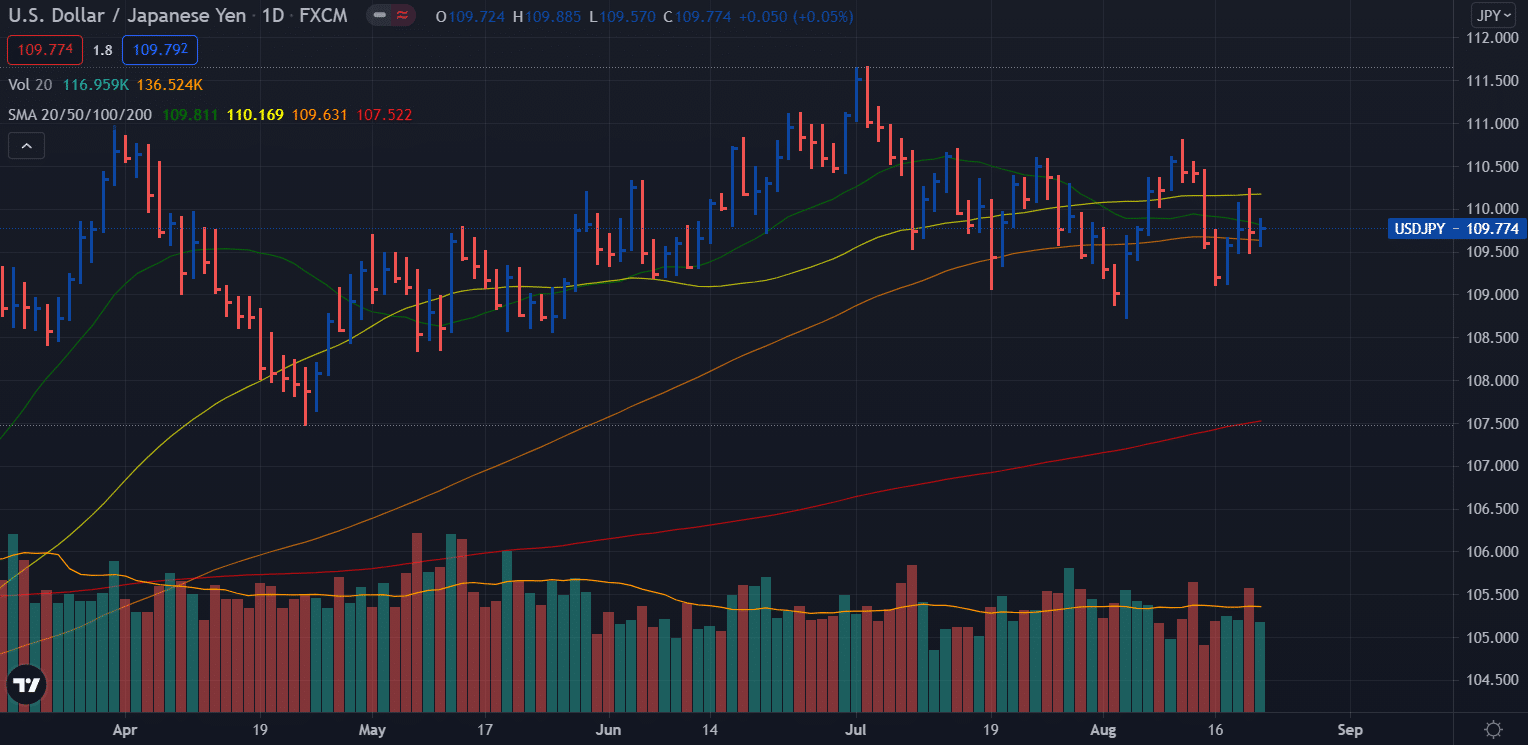

The weekly forecast for the USD/JPY pair is bearish despite the global strength of the US dollar. The USD/JPY started the week at 109.60 while closed at 109.77, with a net gain of 17 pips.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The dollar rose this week, supported by safe trading and confirmation that the Fed set terms for its long-awaited bond cut at its meeting on July 28. However, considering extremely weak retail sales in July and a decline in consumer sentiment in August last week, the US economy needs new data to assess its direction.

There were no signs of an economic slowdown in Japan, and the information was generally in line with expectations. June was a good month for industrial production, although this is not surprising. July’s import and export statistics were most noteworthy. Both imports and exports were lower than expected, even though both were higher than last year. Both of these indicators indicate a slowing economy. According to the national CPI, July’s numbers were negative across all categories, and June’s results had been widely revised downward.

After eight previous periods of falling prices and falling base rates in its fourth month, the July CPI was positive for the second consecutive month.

Consumer sentiment and inflation may pressure consumption in the US, as retail sales declined in July following a sharp drop in consumer sentiment in August. However, despite the weak economy, industrial production and capacity utilization exceeded expectations. In addition, a new pandemic low was reached in the number of initial unemployment benefit applications. As a result, consumer spending remained cautious in the US despite the strong economic recovery.

COVID fears worldwide

Covid-19 Delta cases have been on the rise in many US states and countries around the globe, supporting the dollar’s rise. Most countries did not impose new restrictions, but speculation that growth will slow in the coming months kept oil at low levels all week.

–Are you interested to learn more about forex signals? Check our detailed guide-

Key data releases in Japan during Aug 23-27

- Flash Manufacturing PMI: The previous reading came 53.0 while the forecast for July’s PMI is 52.1, slightly lower than the last month. If data beats expectations, we can see a downside retracement in the USD/JPY.

- BOJ Core CPI y/y: The core inflation excluding food and energy price will be released on Tuesday. The forecast for July is 0.1%, the previous reading. There is no major deviance expected.

- Tokyo Core CPI y/y: Tokyo’s core inflation excluding fresh food prices will be released on Friday. The estimate for July is 0.1% against the previous reading of 0.1%.

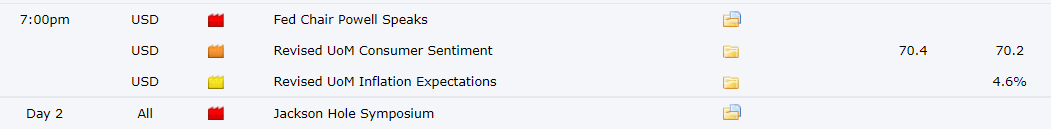

Key data releases in the US during Aug 23-27

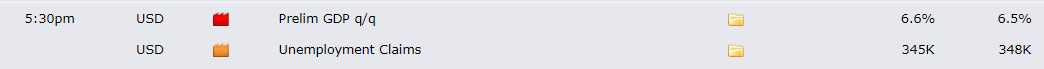

- Prelim GDP q/q: GDP is a primary gauge for economic health. The number is expected to slightly rise to 6.6% against the previous quarter’s reading at 6.5%. Upbeat figures will strengthen the odds of tapering/rate hikes.

- Unemployment claims: The weekly unemployment claims are likely to decrease to 345k against the previous week’s reading at 348k.

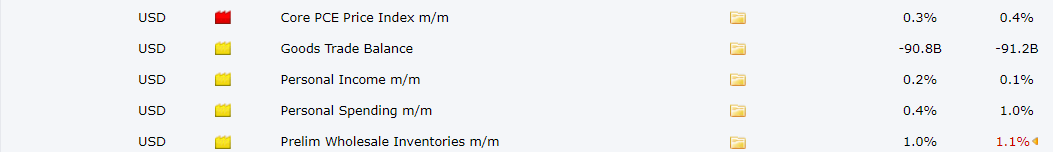

- Core PCE price index m/m: This is one of the most observed indicators to gauge the inflation and economic health of the US. The previous reading was quite dismal that had sent the dollar down. Coming reading for July is expected to slide further to 0.3%. However, any surprise (upbeat figures) can provide further support to the rising Greenback.

- Fed Chair Powell speaks: Investors will look for further clues about tapering and rate hikes on Friday.

- Jackson Hole Symposium (Aug 26-28): The three-day event is the most important release next week. Fed is likely to outline the plan for tapering in the symposium.

USD/JPY weekly technical forecast: More bears to follow

The USD/JPY started the week with a widespread down bar on the daily chart, followed by gains afterwards. However, the gains are capped by the 50-day SMA. The price closed the week below the 20-day SMA, which is a bearish sign. Thursday’s price bar was a down bar with very high volume, while Friday’s bar was a relatively low spread and volume was below the average. This entire scenario indicates for yet another bearish wave to come. Only a sustained recovery beyond 110.40 can shift the bias.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.