The US dollar began the week on the back foot on Trump’s Muslim ban. However, this greenback weakness may not last too long.

Here is their view, courtesy of eFXnews:

Year-to-date, the Dow Jones is up 1.71%, US 10Y yields are up 8bp and EUR/USD is 1 1/2 figure higher. Uncertainty is extraordinarily high given the lack of clarity on US economic policy, the risks of EU fragmentation with the near-term UK-EU Brexit negotiations, and the Dutch and French elections. Markets are struggling to grasp the policy uncertainties as the range of possible outcomes is so diverse. Hence, markets are trading sideways awaiting new information. Still, some markets are trending with German 10Y yields reaching the highest level in a year and bank stocks continuing their march higher.

We expected that there would be a market vacuum during H1 given the lofty expectations following Trump’s win and the challenge he will face to enact fast fiscal stimulus. But it has surprised us how quickly the market vacuum arrived. This can be explained by positioning as the market was very short 10Y UST futures and long US dollars (USD) from the beginning of the year. The market is impatient and as the new US administration seems to have trade as its #1 priority we are not any wiser on fiscal policy (see Chart 1). However, during Trump’s first 100 days in office we should know more about the new US government’s fiscal policy plans. The market is likely to be significantly less short UST futures and long USDs than a couple of weeks back.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Where does this leave us in terms of markets? We see risks skewed towards higher US yields as positioning is probably cleaner now than a couple of weeks back and we will get more details on US fiscal stimulus plans during Trump’s first 100 days in office. Due to the strong US economic data recently, we will look for signs in next week’s FOMC statement on whether the next Fed rate hike could come as soon as March or May. Core European curves should continue to steepen from 5Y and beyond even though they are already at elevated levels (see Chart 2). A dovish ECB should help to reflate the European economy, driving longer-end yields higher.

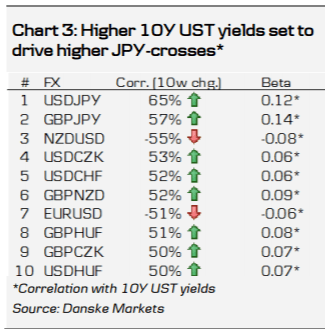

Over the coming 1-3 months, we expect the USD to strengthen in line with the receipt of more detail on the new US government’s fiscal stimulus plans and probably other tariff and tax measures during Trump’s first 100 day in office. We expect JPY-crosses to be the worst hit by reflation, with the USD/JPY likely to head up towards mid-December highs of 118/119.