Donald Trump continues implementing his campaign promises, including those that seemed destined only for the campaign trail and not real policy ones. On Friday, he signed an executive order that bans entries to the US from 7 predominantly Muslim countries.

Hours after Trump’s signature on the bottom line, entrants from these countries were detained and sometimes turned back in US airports. These included Green Card holders as well as other people who had obtained the right to enter the country.

A court in New York temporarily halted the order and this caused confusion. The White House then explained that it doesn’t apply to Green Card holders, adding, even more, confusion. The move was globally condemned and also received criticism from his own party.

Dollar downed

When markets opened in Asia, the dollar fell. EUR/USD jumped to a high of 1.0740, maintaining the gap and holding above 1.07 as the hours passed by.

EUR/USD: To Rally Towards 1.10 Short-Term; Sell Into This Rally Long-Term – SEB

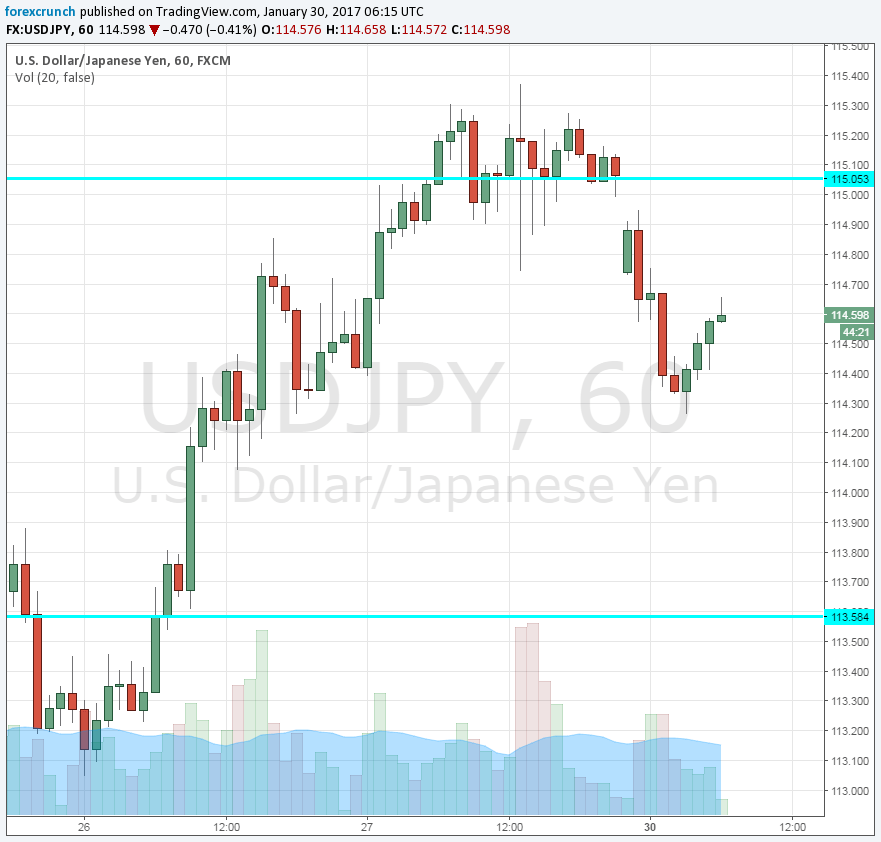

USDJPY, which often reflects risk, dropped to 114.60. The yen attracts safe haven flows. GBP/USD, which is influenced by Brexit worries, is up to 1.2570.

Will this continue? This is a big question. It seems that the administration is reacting to the backlash and beginning to back down. A refocus of the media on other topics could also help and provide a buy opportunity on the US dollar.

However, if Donald doubles down on the measures, defying his own Chief of Staff Reince Priebus and others, things could get worse.

More: The Dollar Trump Slump [Video]