The US dollar began 2017 with a storm, reaching 14-year highs against the euro before taking the other direction. What’s next?

Here is their view, courtesy of eFXnews:

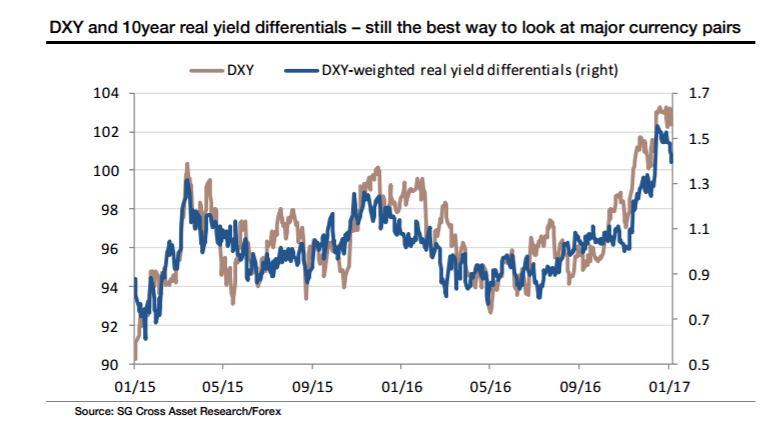

Over the last few years, the relationship between FX rates and interest rate differentials has shifted. The chart below shows DXY-weighted 10year real yield differentials next to the DXY index. Not perfect, but not bad. This fit is better than for 10year nominal yields, and better than for 10 or 2 year swap differentials for that matter and for now, it’s going to remain a corner-stone of how we think about FX trends in 2016. This relationship is interesting and useful but of course, it largely swaps one problem – trying to forecast FX trends by looking at the wrong things – while creating another – trying to forecast trends in real yield

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

As for timing on a dollar peak, our best guess is 99 days of President Trump’s inauguration. That’s absurdly precise but markets have embraced the idea that the new president is good for business confidence and will be good for the economy through policies that reduce taxation, increase spending, and reduce regulation. By the time his first hundred days are over, we might well be in a state of sever over-excitement. 99 days after inauguration takes us to 29 April, the day before the first round Presidential vote in France.

We’re pencilling in parity for the EUR/USD and the year’s widest level for relative real yields for that period too.