The US dollar is looking for a new direction ahead of the tight US elections and as uncertainty about the timing of the next Fed move still prevails.

Here is their view, courtesy of eFXnews:

We think the USD is likely to trade on a better footing, at least against some G10 counterparts as we progress through Q4.The search for yield will continue to propel higher-yielding commodity and EM currencies. Inevitably, however, carry trades rest on mix of low vol and steady returns. We are increasingly skeptical that this dynamic will extend well into Q4. As currency markets wrestle with the cross currents of rising political risks, the rotation from monetary to fiscal policy cues, and a less clear delineation between risk and reward, we expect investors to go ‘back to basics’. This favors modest USD upside into the final months of the year.

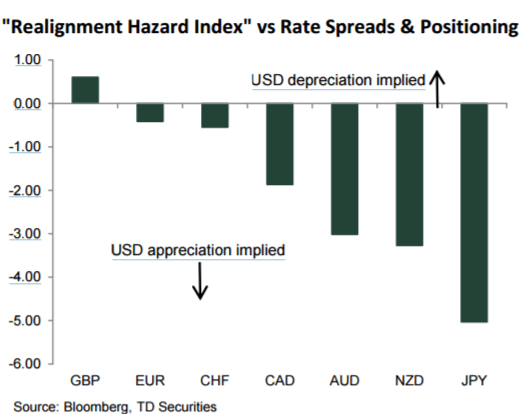

Specifically, we note that the deviation between rate spreads and FX is particularly pronounced in some currencies. Political risks could also favour the greenback with the Italian referendum scheduled for the first week of December.

The JPY, NZD, and AUD are at the greatest risk of a sharp realignment with these fundamentals, especially when market positioning indicators are overlaid. This comes, crucially, just as the USD’s overall correlation with our measure of US economic data surprises has started to strengthen after a period of less reliability earlier this year. Even so, the tone of the USD strength is likely to be less pronounced than prior rallies given subdued expectations about the pace of the Fed’s normalization and questions over the outlook for the US economy over the coming years.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.