The US dollar had a mixed September, rising against some currencies while losing against others. Looking forward, the team at Goldman Sachs sees appreciation coming, and here is their explanation:

Here is their view, courtesy of eFXnews:

Much of the focus in recent weeks has been on whether the Fed will hike rates this year.

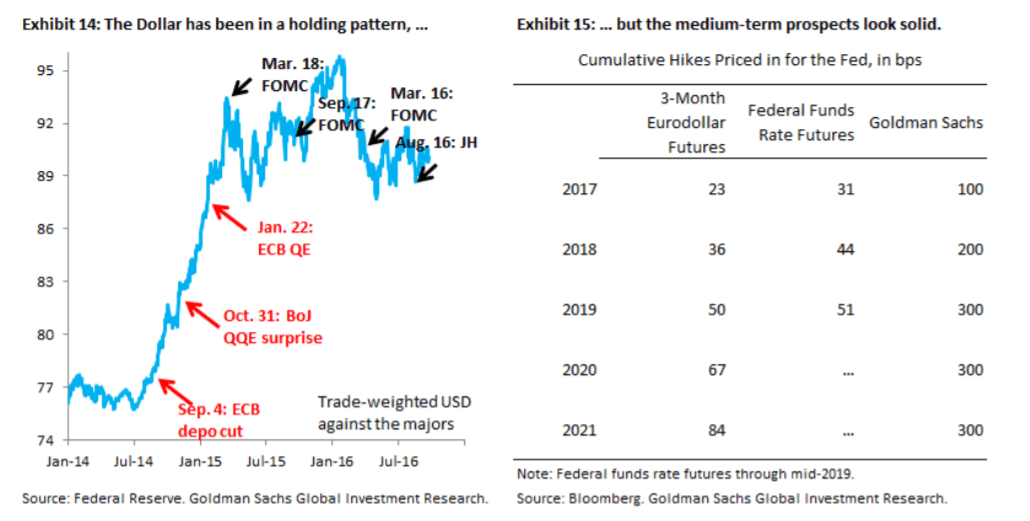

We side-step that debate and work backwards, looking at what interest rate futures price in the medium term. Through mid-2019, i.e., over the next three years, fed funds futures suggest that little more than two hikes are priced , which is low even by the standards of the most ardent R-Star proponent. Further out, Eurodollar contracts show less than four hikes by 2021. One question is why market pricing is so low, something we revisit below, but – with the market so dovish – this is almost beside the point. With Vice Chair Fischer floating two hikes in 2016 at Jackson Hole, two hikes in three years is low.

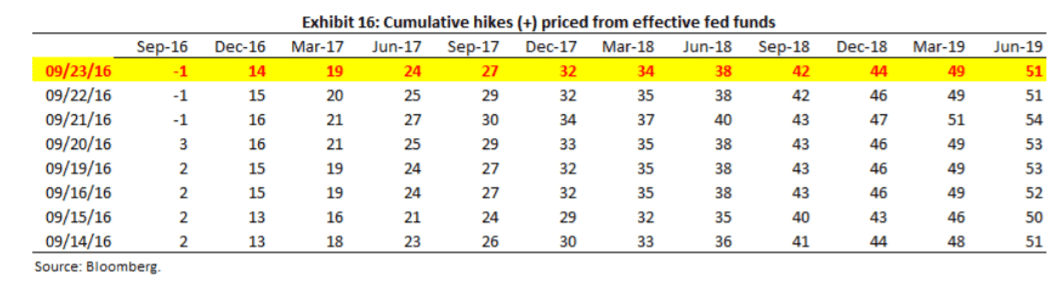

More short term, fed funds price 15bp for November and December combined, making the back and forth in Fed speak almost a side issue. In the end, markets are still reluctant to commit to a hike this year, which translates into upside for the Dollar into year-end.

The Dollar is something of a conundrum for the Fed. After many years of extraordinarily loose monetary policy, the Dollar is subject to large appreciation pressure. This complicates life for the Fed, because any hawkish shift could see the Dollar rise sharply, as in the aftermath of Jackson Hole, threatening – via the negative hit to growth and inflation – to undermine the very rationale for the hawkish shift. Governor Brainard noted as much in a recent speech when she recognised the rising sensitivity of the Dollar to Fed surprises, something we have also documented.

On top of China worries, this might argue for a less predictable and perhaps shallower hiking cycle than we forecast, with prolonged pauses between hikes to manage expectations. This could reduce Dollar upside.

We still expect that the 300bp tightening cycle forecast by our US team maps into a 15% rise of the Dollar.

A 200bp cycle maps into two-thirds of that and so forth. By backward induction, given how dovish market pricing is, the hurdle for the Dollar to rally is low, while the hurdle for it to fall in any meaningful way is substantial.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.