The Canadian dollar enjoyed the great Canadian jobs report but in general, lacks a direction. The team at CIBC dives into this:

Here is their view, courtesy of eFXnews:

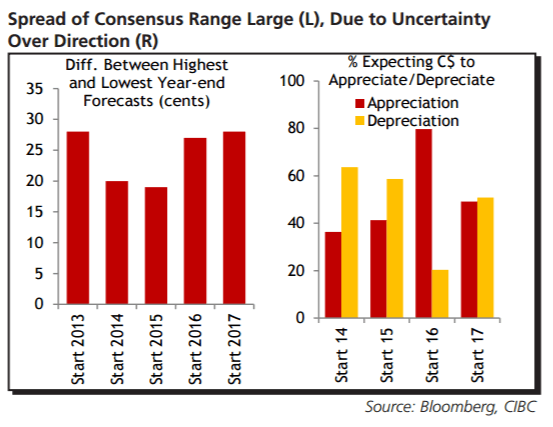

Movements in oil and by extension the Canadian dollar have become less dramatic than they were in the prior two years. However, that hasn’t translated into a narrower range of forecasts for the currency over the coming year.

In fact, the spread between the highest and lowest forecast is much higher than it was at the start of 2014 and 2015, and narrowly more than at the start of last year when the C$ was in rapid decent.

Why? In previous years, while there was a divergence of opinion regarding the scale of the move, there was often a broad consensus on the direction. That’s not the case this year, with the consensus at the start of the year split almost 50/50 between those expecting an appreciation or depreciation.

Even after this week’s good start, we remain on the pessimistic side, seeing a depreciation of the loonie and USDCAD rising to 1.37 at year-end.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.