Dollar/CAD moved up, correction previous losses as oil prices cooled down. The upcoming week features housing figures from Canada. Here are the highlights and an updated technical analysis for USD/CAD.

Canada reported a drop in the unemployment rate to 6.3%, but this wasn’t enough to mitigate the impact of the US jobs report. An OK NFP triggered a US dollar rally. The US dollar was on the back foot on the White House chaos. But for a change, the loonie was unable to take advantage of this. Oil prices fell from the highs it reached last week and this was the sign for the C$ to retreat.

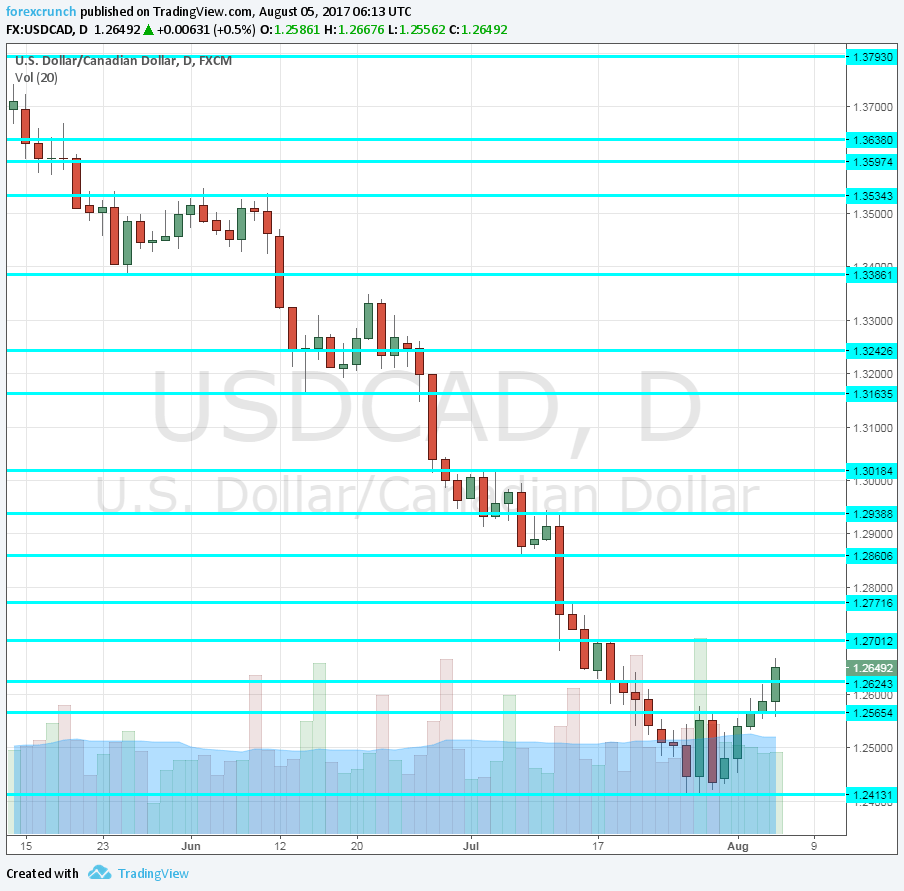

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Housing Starts: Tuesday, 12:15. The Canadian housing sector has been rocked by reports of house price falls in Toronto. Nevertheless, the sector as a whole continues rising. Back in June, housing starts advanced to 213K. A small slide to 206K is on the cards now.

- Building Permits: Wednesday, 12:30. While this indicator is not as fresh as the housing starts one, it provides a wider scope. Also here, permits were up a whopping 8.9% in May. A drop of 1.8% is forecast now.

- NHPI: Thursday, 12:30. The third housing indicator of the week relates to prices of new homes. In May, the advance surprised for the second month in a row, with +0.7% after 0.8% beforehand. A slightly more modest rise of 0.5% is projected.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD was unable to break below 1.2410, which establishes itself as strong support. From there, the pair went north.

Technical lines from top to bottom:

1.2860 was a relatively significant stepping stone on the way down, holding the pair for some time. It is followed by 1.2775, which marked a recovery attempt.

1.27 is a round number and also the top of a short-lived range. 1.2640 was the bottom of that range and a level where the pair reached after bouncing back.

1.2580 is a pivotal line and capped the pair temporarily on its recovery path. 1.2410 is a very strong line, serving as the low for 2017 (so far).

Further down, we find levels last seen in early 2015. These levels are 1.22 and 1.20.

I am bearish on USD/CAD

The Canadian dollar made the necessary fall after long weeks of gains. However, the Canadian economy looks great while the US is still embroiled in the political mess.

Our latest podcast is titled Draghi Dud and the Petrol Pendulum

Follow us on Sticher or iTunes

Safe trading!