USD/CAD showed limited movement for a second straight week, closing at 1.3358. This week’s highlights are GDP and Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, Janet Yellen provided strong hints that the Fed will raise rates next week, lauding the labor market and dismissing persistently weak inflation. The critical NFP came in above expectations, but the ISM PMIs disappointed. Canadian GDP missed expectations and employment numbers disappointed, but the Canadian dollar managed to hold its own against the greenback.

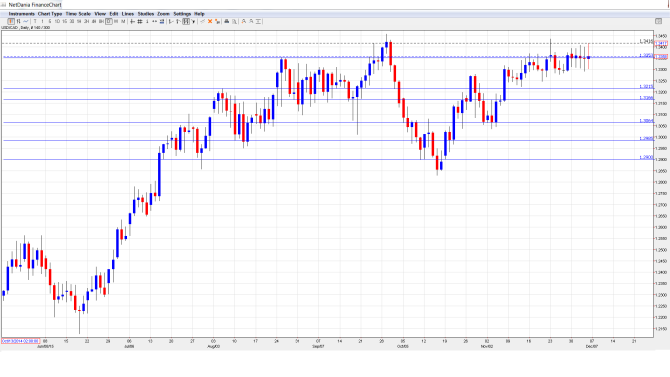

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Housing Starts: Tuesday, 13:15. Housing Starts slipped in November to 198 thousand, short of the forecast of 200 thousand.

- Building Permits: Tuesday, 13:30. Building Permits is the first key event of the week. The indicator has struggled, posting four declines in the past five events. Will the indicator bounce back with a positive reading in the October report?

- BOC Governor Stephen Poloz Speaks: Tuesday, 17:50. Poloz will speak at an event in Toronto. The markets will be looking for hints as to the BOC’s future monetary policy.

- NHPI: Thursday, 13:30. This housing inflation index provides a snapshot of the level of activity in the housing sector. The index continues to provide weak gains, and posted a gain of 0.1% in September, within expectations. An identical gain of 0.1% is forecast the October report.

* All times are GMT.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3368 and touched a low of 1.3291. The pair touched a high of 1.3416 late in the week, as resistance held firm at 1.3443 (discussed last week). USD/CAD closed the week at 1.3358.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

We begin with resistance at 1.3759.

1.3587 was a cap in March 2004.

1.3443 has held firm since late September.

1.3353 remains busy and was tested last week. It is currently a weak support line.

1.3213 is a strong support level.

1.3165 is next.

1.3063 is protecting the symbolic 1.30 line.

1.2985 was an important cushion in September.

The very round line of 1.2900 is the final line of support for now.

I am bullish on USD/CAD

With speculation rising that the Fed will press the rate trigger next week, market sentiment will likely remain positive regarding the US dollar. The US economy continues to outperform that of Canada, and monetary divergence will continue to weigh on the Canadian dollar.

Our latest podcast is about Expectations and Disappointments in EUR, USD and Oil

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.