The Canadian dollar posted modest gains last week, as USD/CAD closed the week at 1.3845. This week has just two events on the calendar. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, employment numbers improved, as Unemployment Claims dropped to 262 thousand. CPI and Core CPI edged above their estimates, reviving speculation about a March rate hike. Canadian numbers were mixed, as Manufacturing Production beat the forecast, while Core Retail Sales posted sharp decline and missed expectations.

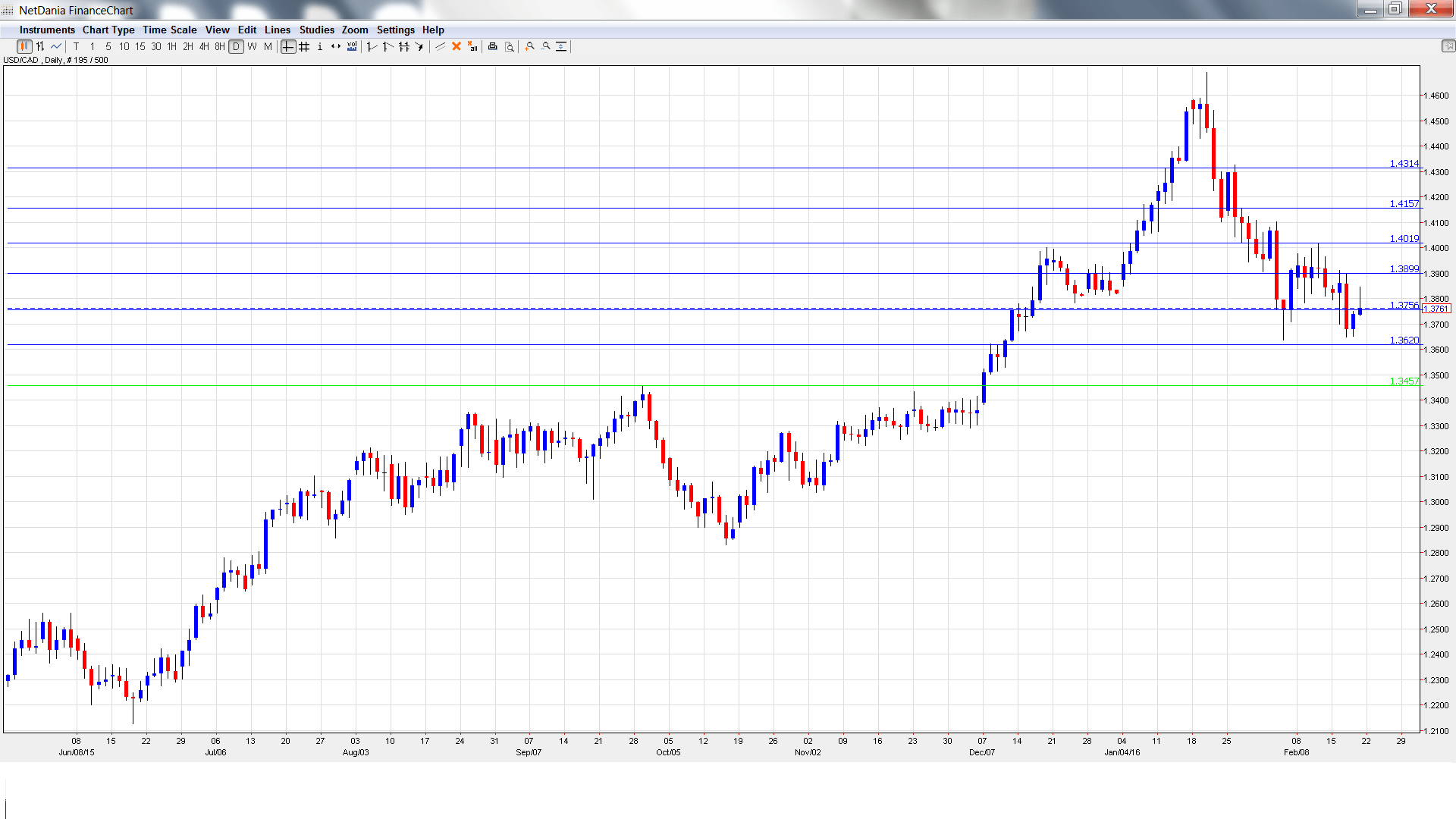

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- BOC Deputy Governor Lawrence Schembri Speaks: Wednesday, 17:30. Schembri will speak at an event in Sudbury. The markets will be looking for hints regarding the BOC’s future plans regarding interest rate moves.

- Corporate Profits: Thursday, 13:30. This indicator is released on a quarterly basis, magnifying the impact of each reading. The indicator has shown strong volatility, and posted a decline of 5.4% in the third quarter, compared to a sharp gain of 12.9% in the previous quarter. Will we see a reading in positive territory in the upcoming release?

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3883 and dropped to a low of 1.3784, as support held firm at 1.3757 (discussed last week). The pair then reversed directions and climbed to a high of 1.4016. USD/CAD softened late in the week and closed at 1.3845.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

We begin with resistance at 1.4310, which has held since late January.

1.4159 is the next line of resistance.

1.4019 has strengthened in resistance as the pair trades at lower level.

The round number of 1.39 has switched to a resistance role. It is a weak line and could see further action during the week.

1.3757 was a cap in December.

1.3620 is the next support line.

1.3457 is the final support level for now.

I am neutral on USD/CAD

The US economy has slowed down in 2016, but last week’s employment and inflation numbers beat expectations, so a March rate hike is again on the table. The Canadian dollar has improved in recent weeks, although weak oil prices continue to weigh on the currency.

Our latest podcast is titled Oil’n’gold merry go round

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.