The Canadian dollar suffered another gut wrenching week, as USD/CAD jumped 350 points. The pair closed at 1.4528, its highest level since April 2003. This week’s highlights are Core CPI and Core Retail Sales. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The US recorded weak retail sales and inflation numbers last week, but consumer confidence levels beat expectations. The BOC quarterly business survey was pessimistic, noting that the negative repercussions of the oil price shock continue to spread to other sectors of the economy.

[do action=”autoupdate” tag=”USDCADUpdate”/]- Foreign Securities Purchases: Tuesday, 13:30. The indicator surged in October, posting a gain of C$22.1 billion, crushing the estimate of C$6.13 billion. The estimate for the November report stands at C$12.1 billion.

- Manufacturing Sales: Wednesday, 13:30. This is the first key event of the week. The estimate has looked awful, posting three straight declines. In October, the indicator posted a sharp drop of 1.1%, much weaker than the forecast of -0.4%. Will we see an improvement in the November report?

- Wholesale Sales: Wednesday, 13:30. Wholesale Sales continues to struggle and has failed to post a gain since June 2015. The October reading came in at -0.6%, compared to an estimate of +0.1%.

- BOC Overnight Rate: Wednesday, 15:00.

- BOC Monetary Policy Report: Wednesday, 15:00. This report provides insight into the BOC’s view of the economy and inflation, and analysts will be looking for clues as to the BOC’s future monetary policy.

- Core CPI: Friday, 13:30. Core CPI excludes automobile sales, which are volatile and can distort the underlying trend. This indicator is used by the BOC when measuring consumer spending. The indicator posted a flat 0.0% in October, short of the estimate of +0.4%. The index has not posted a gain since June.

- Core Retail Sales: Friday, 13:30. The indicator continues to struggle, having not posted a gain since June. This points to weak consumer spending, which is not good news for the economy or the Canadian dollar.

- CPI: Friday, 13:30. CPI remains at low levels and came in at -0.1% in November, shy of the estimate of +0.1%. Will we see any improvement in the December report?

- Retail Sales: Friday, 13:30. Retail Sales is the primary gauge of consumer spending. The indicator posted a small gain of 0.1%, shy of the forecast of 0.4%.

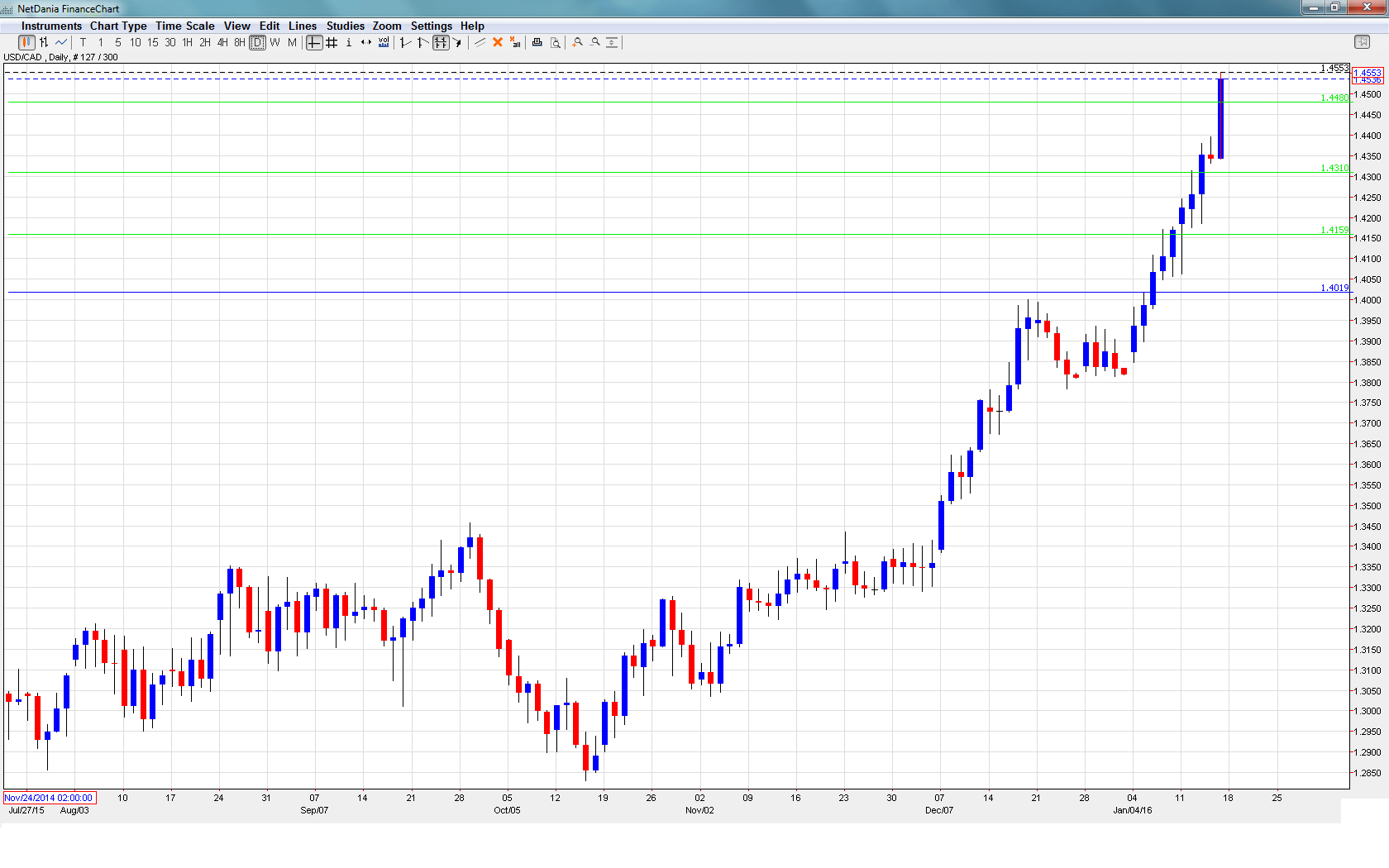

USD/CAD Technical Analysis

USD/CAD opened the week at 1.4183 and quickly dropped to a low of 1.4063, as support held firm at 1.4019 (discussed last week). It was all uphill from there, as the pair climbed to a high of 1.4553. USD/CAD closed the week at 1.4528.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

With USD/CAD posting sharp gains last week, we start at higher levels:

There is resistance at 1.4826.

1.4754 was a cushion in May 2000.

1.4584 is next.

1.4480 is providing weak support. This line was an important cushion in April 2000.

1.4310 is the next line of resistance.

1.4159 was breached as the pair surged and has switched to a support level.

1.4019 is the final support line for now.

I am bullish on USD/CAD

The Canadian dollar has been in a free-fall in January, plunging close to 700 points. With investors continuing to avoid risk due to events in China and geopolitical tensions, the safe-haven US dollar could continue to make gains at expense of the Canadian dollar.

In our latest podcast we explain China and grill the Fed

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.