The Canadian dollar was uneventful in the final week of 2015, as USD/CAD was unchanged. The pair closed at 1.3830. There are seven events this week. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

US numbers were not impressive last week, as unemployment claims and housing reports were short of expectations. There was some better news from consumer confidence, which beat the forecast. There were no Canadian releases during Christmas week.

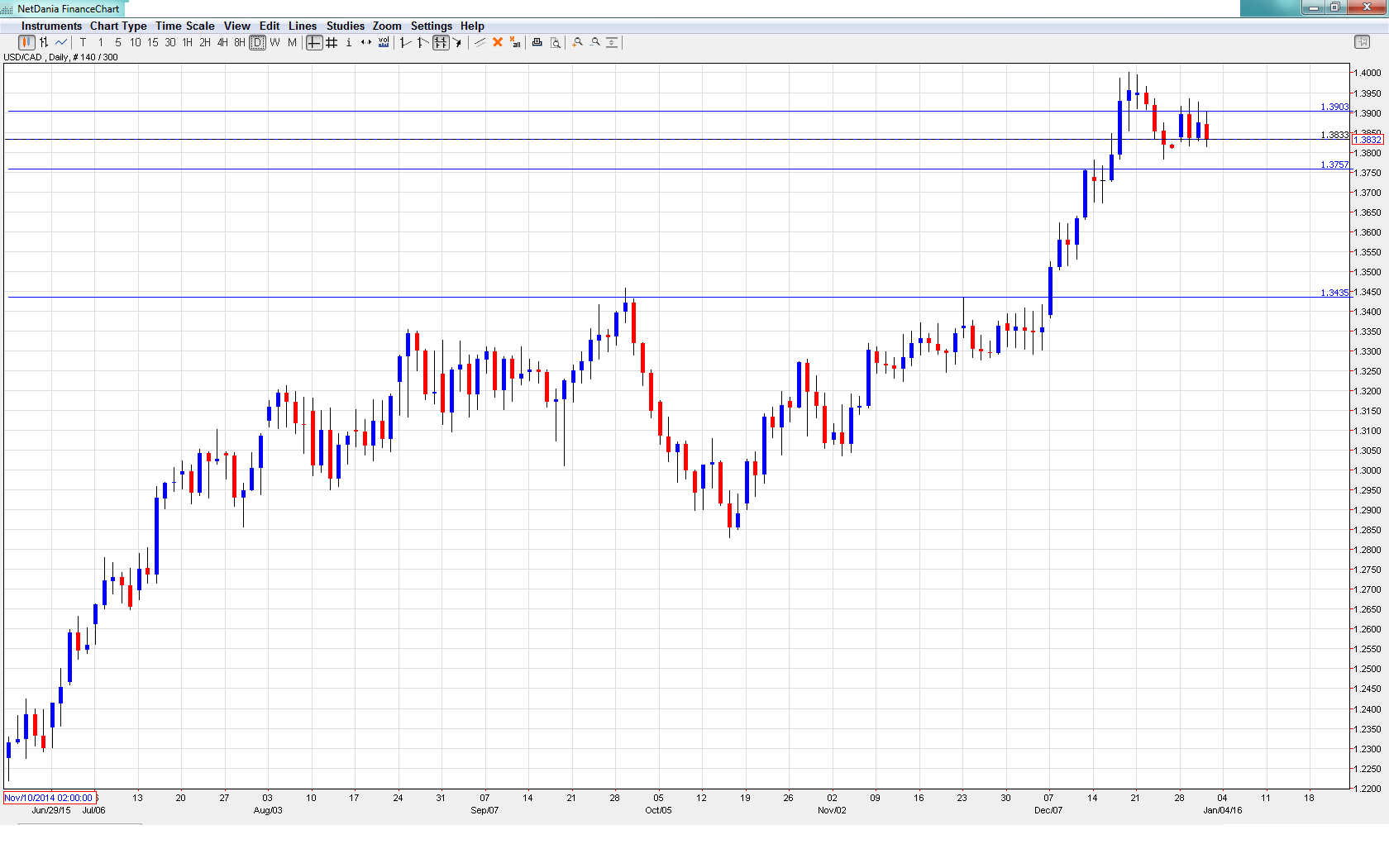

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- RBC Manufacturing PMI: Monday, 9:30. Manufacturing PMI has posted four straight readings below the 50-point level, indicative of ongoing contraction in the manufacturing sector. The indicator came in at 48.6 points in the November report. Will we see an improvement in December?

- RMPI: Tuesday, 8:30. RMPI measures inflation in the manufacturing sector. The index posted a gain of 0.4%, matching the forecast. The markets are bracing for a sharp downturn, with an estimate of -2.3%.

- Trade Balance: Wednesday, 8:30. Trade Balance is closely linked to currency demand, as foreigners must buy Canadian dollars in order to purchase Canadians goods and services. The trade deficit ballooned to C$2.8 billion, marking a five-month high. This figure was much higher than the estimate of C$1.7 billion. Another weak reading is expected, with an estimate of C$2.6 billion.

- BOC Governor Stephen Poloz Speaks: Wednesday, 8:25. Poloz will deliver remarks at an event in Ottawa. The markets will be listening for clues as to the BOC’s future monetary policy.

- Ivey PMI: Thursday, 10:00. Ivey PMI sparkled in November, surging to 63.6 points. This crushed the forecast of 55.3 points. The indicator is expected to retract to 56.7 points in the December report, which would still point to expansion.

- Building Permits: Friday, 8:30. Building Permits broke a streak of three declines in October, with an excellent gain of 9.1%, crushing the estimate of 3.0%. The markets are expecting a sharp reversal in October, with a forecast of -3.2%.

- Employment Change: Friday, 8:30. Employment Change is one of the most important economic indicators, and an unexpected reading can have a sharp impact on the movement of USD/CAD. The indicator had a dismal November, coming in at -35.7 thousand, much weaker than the estimate of -9.7 thousand. Better tidings are expected in December, with an estimate of +10.4 thousand. The Unemployment Rate is expected to remain pegged at 7.1%.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3837 and quickly dropped to a low of 1.3813. The pair then reversed directions, climbing to a high of 1.3935, as it tested resistance at 1.39 (discussed last week). USD/CAD closed the week at 1.3833.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

We begin with resistance at 1.4310.

1.4157 was an important cushion in April 2003.

1.4003 is the next resistance line, just above the psychologically important 1.40 level.

The round number of 1.39 remains busy and was tested last week in resistance. It could see further action earlier in the week.

1.3759 continues to provide support.

1.3587 was a cap in March 2004.

1.3435 has held firm since early December. It is the final support line for now.

I am bullish on USD/CAD

The Canadian dollar held its own last week, but the US currency could resume its rally and push towards the symbolic 1.40 line. Even if US figures are mediocre, the Fed is set to raise rates again early in the New Year, which is bullish for the greenback.

Here is our 2016 Financial Markets Guide:

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.