The Canadian dollar posted sharp losses last week, dropping 200 points. USD/CAD closed at 1.3255. This week’s key event is GDP. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The US dollar gained ground last week on hawkish comments released by various Fed officials, leaving an April hike a real possibility and contrasting the very dovish sentiment aired in the decision from the previous week. US Final GDP beat expectations with a gain of 1.4% in the four quarter.

Updates:

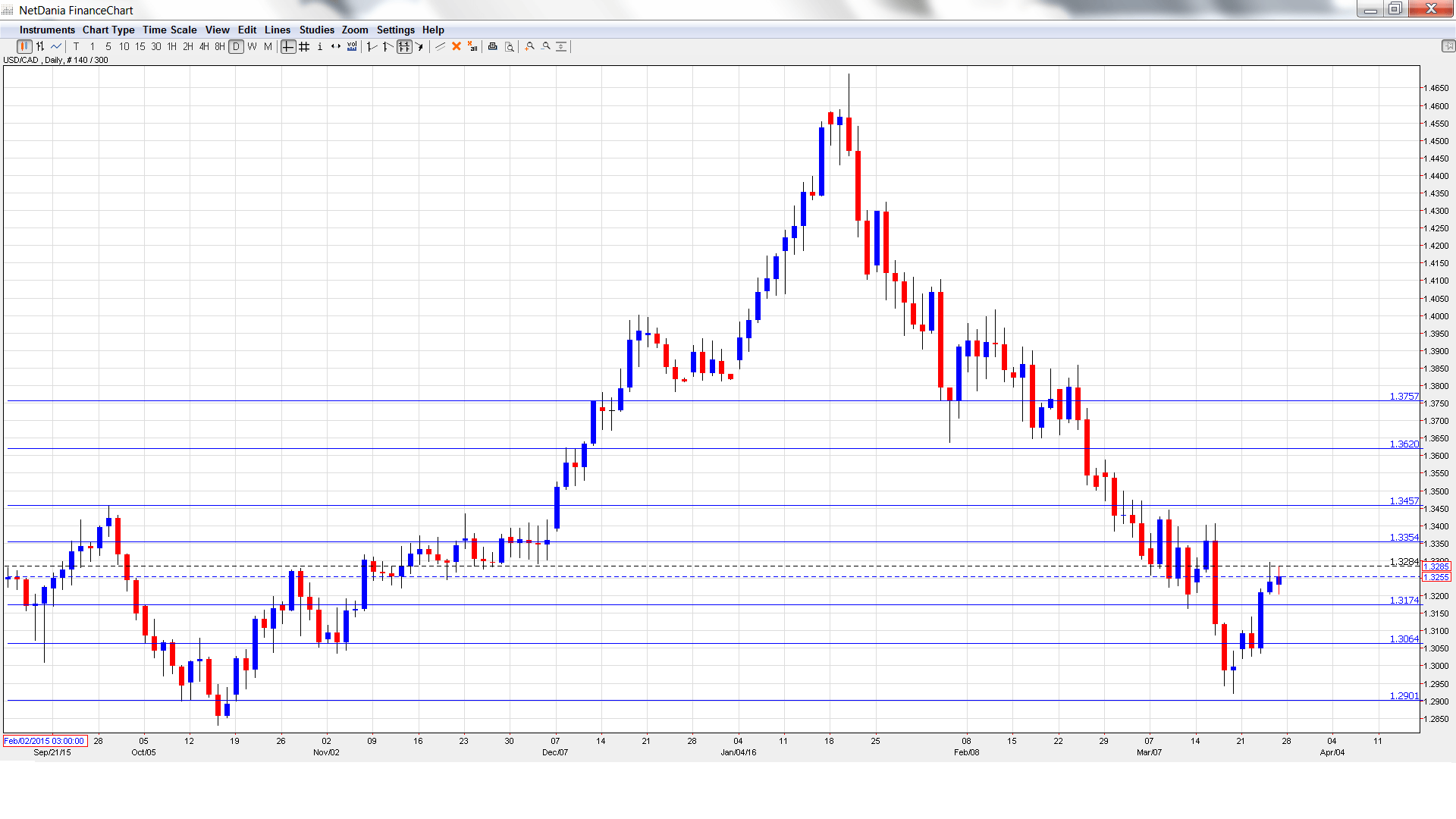

USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- RMPI: Tuesday, 12:30. The manufacturing inflation indicator posted a third straight decline, coming in at -0.4%. The downward trend is expected to continue in February, with a forecast of -0.8%.

- BOC Deputy Governor Lynn Patterson Speaks: Tuesday, 18:35. Patterson will speak at an event in Edmonton. A hawkish speech is bullish for the Canadian dollar.

- GDP: Thursday, 12:30. Canada releases GDP every month, unlike other countries that release the indicator on a quarterly basis. GDP dipped to 0.2% in January, and the estimate for February stands at 0.3%.

- RBC Manufacturing PMI: Friday, 13:30. This PMI continues to point to contraction in the manufacturing sector. The February release came in at 49.4 points, almost unchanged from the reading of 49.3 points a month earlier.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3047 and quickly touched a low of 1.3021. The pair climbed to a high of 1.3296, as resistance held firm at 1.3353 (discussed last week). USD/CAD closed the week at 1.3255.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

With USD/CAD climbing higher, we start with resistance at higher levels:

1.3757 is a strong resistance line.

1.3620 has held firm since late February.

1.3457 is the next resistance line.

1.3353 held firm in resistance as the pair posted strong gains last week.

13174 was a cap in October 2015.

1.3064 is protecting the symbolic 1.30 line.

The round number of 1.2900 was a cushion in October.

1.2780 is the final support level for now.

I am bullish on USD/CAD

Last week’s flurry of hawkish statements from Fed members indicates that the Fed is actually not so dovish, which is bullish for the US dollar. We’ll hear from Janet Yellen next week, and the US dollar could gain ground if she leaves the door open to an April or June rate hike. A weak Canadian GDP could weigh on the Canadian dollar.

In our latest podcast we crunch some commodities

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.