USD/CAD recorded strong gains, as the pair jumped 150 points last week. The pair closed at 1.3283. It’s a light holiday schedule this week, with only two events. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Canadian job market sparkled in August, as the economy added 67.2 thousand jobs in August. However, the Canadian dollar failed to take advantage and posted losses despite this release. In the US, NFP fell short of expectations, but the greenback shrugged off this reading, as wage growth and jobless numbers were more upbeat.

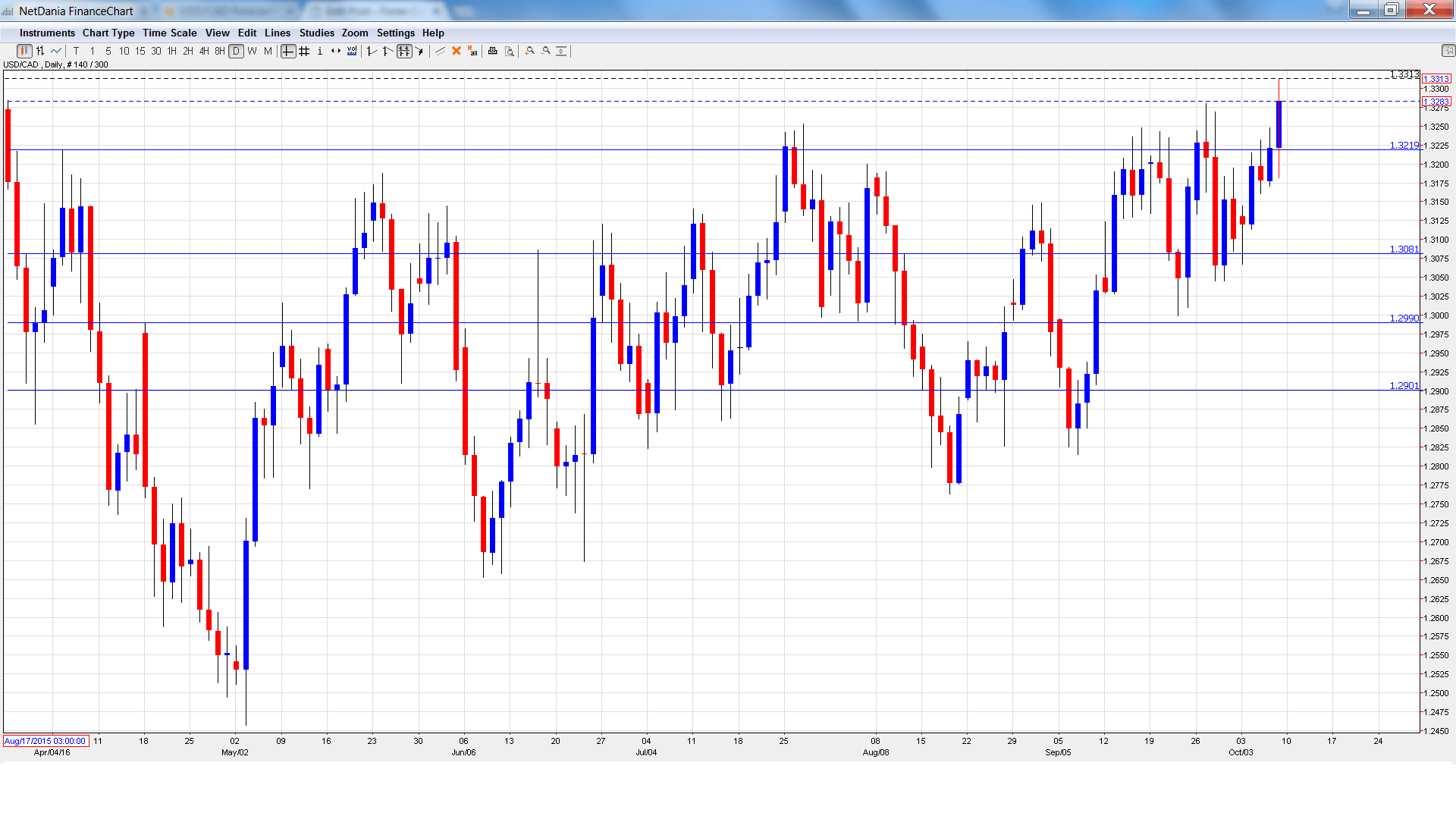

USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Housing Starts: Tuesday, 12:15. Housing Starts was unexpectedly weak in August, dropping to 183 thousand. This figure was well below the estimate of 191 thousand and marked the indicator’s lowest level in 2016. The markets are expecting better news in September, with an estimate of 194 thousand.

- NHPI: Thursday, 12:30. This housing inflation index provides a snapshot of the level of activity in the housing sector. The index improved in July, posting a gain of 0.4%. The estimate for the August release stands at 0.3%.

USD/CAD opened the week at 1.3130 and quickly touched a low of 1.3067. It was all uphill from there, as USD/CAD climbed to a high of 1.3313, as resistance held at 1.3353 (discussed last week). The pair closed at 1.3283.

Live chart of USD/CAD:

Technical lines, from top to bottom

We begin with resistance at 1.3672.

1.3551 has provided resistance since March 2016.

1.3457 was a cap in September 2015.

1.3353 has switched to a support line following sharp gains by USD/CAD last week.

1.3219 was a cap in April.

1.3081 is the next support line.

1.2990 has held firm since early September.

The round number of 1.2900 is the final support line for now.

I remain bullish on USD/CAD

The Canadian dollar failed to make any headway despite higher oil prices and strong job numbers. US numbers have generally been positive, so a December rate hike remains on the table, which is bullish for the greenback.

Our latest podcast is titled Bold BOJ vs. Fearful Fed

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.