Dollar/CAD consolidated its losses and defined a new, lower range. The upcoming week features inflation data among other figures. Here are the highlights and an updated technical analysis for USD/CAD.

Data in Canada was positive, with a beat in housing starts and also in the NFPI. Together with a rise in oil prices, it was enough to hold back the comeback of the greenback. Can this stability continue? The recent past points to resumption of the downtrend after this consolidation phase.

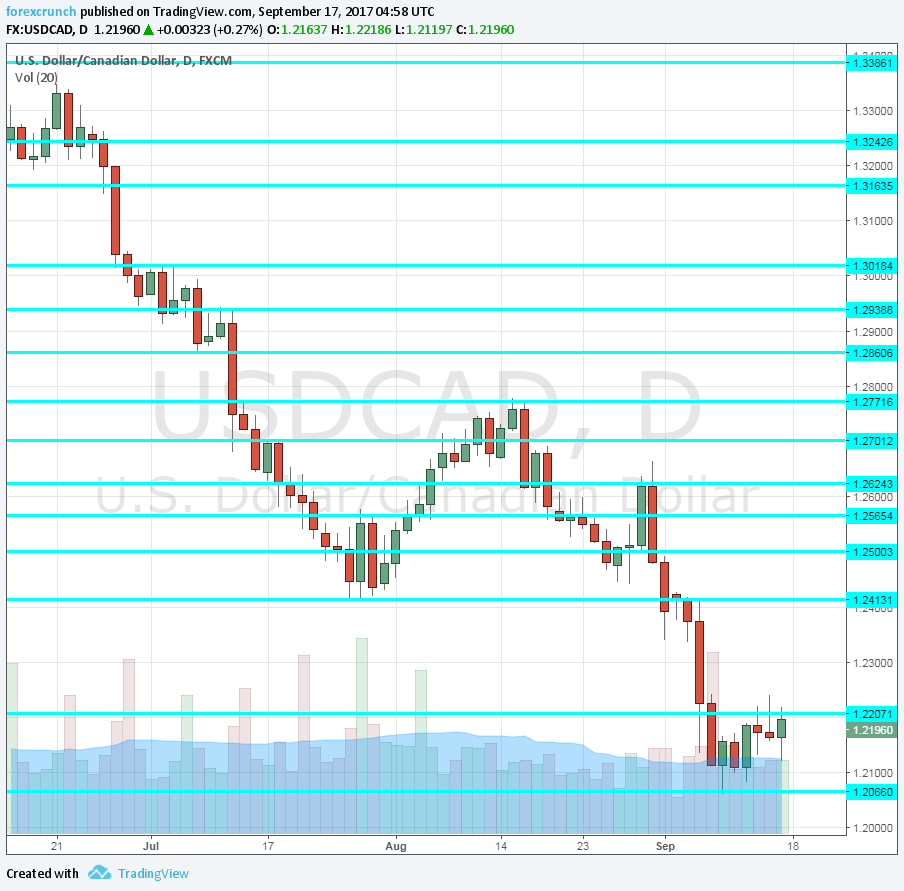

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Foreign Securities Purchases: Monday, 12:30. This monthly report reflects the inflows or outflows of foreign monies into Canada. A surprising outflow was recorded in June, but it was less than 1 billion. An inflow of 4.46 billion is on the cards now.

- Manufacturing Sales: Tuesday, 12:30. After three consecutive months of rises, the volume of sales dropped in June by a 1.8%, worse than had been expected. Another slide is on the cards for July: 1.8%.

- Wholesale Sales: Thursday, 12:30. Sales at the wholesale level eventually reach the retail level. Similar to manufacturing sales, a drop was recorded after several months of increases. After a slide of 0.5%, another squeeze of 0.9% is on the cards for June.

- CPI: Friday, 12:30. The Bank of Canada has raised rates because it sees inflation in the pipeline. Are their assumptions correct? We will get an insight with the inflation report for August. Headline monthly CPI is expected to rise by 0.2% after remaining flat in July. Core CPI dropped by 0.1% last time. The Bank also publishes other measures of core inflation: Common CPI rose by 1.4% y/y in July, the Median CPI by 1.7% and the Trimmed CPI by 1.3%. Any advances in these measures will boost the loonie.

- Retail sales: Friday, 12:30. This report competes with the inflation one. Nevertheless, consumption is important as well. Retail sales are expected to rise by 0.1% in July after the same scale was recorded in June. Core sales carry expectations for 0.4% after 0.7%.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD traded in ranges described last week.

Technical lines from top to bottom:

1.27 is a round number and also the top of a short-lived range. 1.2640 was the bottom of that range and a level where the pair reached after bouncing back.

1.2580 is a pivotal line and capped the pair temporarily on its recovery path. 1.25, a very round number, provided support for the pair in August.

1.2410 held the pair cushioned for some time, but was eventually broken. 1.22 is a round number and also worked as support a few years ago.

1.2065 is the (current) swing low of September 2017. It is followed by the obvious level of 1.20.

Below 1.20, we find 1.1925.a place of support as it worked as such in early 2015. Below that point, we see 1.17.

I remain bearish on USD/CAD

Everything is going in favor of the Canadian dollar and it even had its period of consolidation. A consolidation now in the US dollar’s wide gains could allow the loonie to resume its rise, especially if the inflation report is favorable.

Our latest podcast is titled Everything you need to know for September

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!