Dollar/CAD had an interesting week, moving on both Canadian data and on the Fed decision. The upcoming week features the GDP release. Here are the highlights and an updated technical analysis for USD/CAD.

Canadian manufacturing sales dropped by 2.6%, more than expected, but wholesales sales advanced by 1.5%. Oil prices helped the loonie while a relatively hawkish Fed gave a boost to the greenback. All in all, the pair moved a bit higher, but still seems to be in a phase of consolidation.

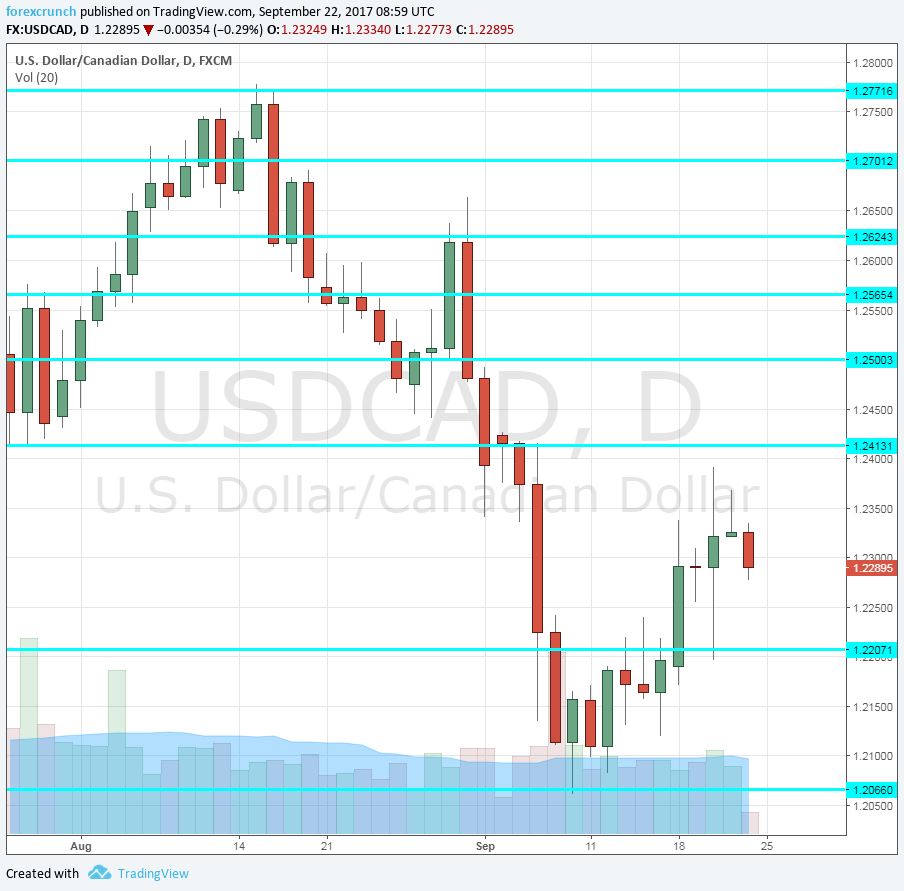

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- GDP: Friday, 12:30. The Canadian economy is looking good. It grew by an annualized rate of 4.5% in the second quarter of 2017 and 0.3% in June. The figure for July, released now, provides the first look into the third quarter.

- RMPI: Friday, 12:30. The Raw Materials Price Index has been falling in the past few months, with a disappointing drop of 0.6% in July. Nevertheless, the Canadian economy is not only about raw materials.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD broke above 1.22 (mentioned last week) and held its ground.

Technical lines from top to bottom:

1.27 is a round number and also the top of a short-lived range. 1.2640 was the bottom of that range and a level where the pair reached after bouncing back.

1.2580 is a pivotal line and capped the pair temporarily on its recovery path. 1.25, a very round number, provided support for the pair in August.

1.2410 held the pair cushioned for some time but was eventually broken. 1.22 is a round number and also worked as support a few years ago.

1.2065 is the (current) swing low of September 2017. It is followed by the obvious level of 1.20.

Below 1.20, we find 1.1925.a place of support as it worked as such in early 2015. Below that point, we see 1.17.

I am bearish on USD/CAD

With robust economic data and a hesitant Fed, the pair has room to the downside.

Our latest podcast is titled Fed mysteries and dismissing missiles

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!