The Canadian dollar has suffered from falling oil prices, the election results and the cut of forecasts by the BOC.

What’s next on the technical level? The team at SocGen identifies an inverted Head and Shoulders pattern:

Here is their view, courtesy of eFXnews:

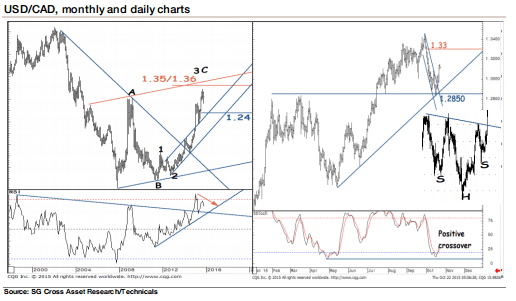

After a short-term retracement, USD/CAD has found support at the previous high of 1.2850, the ascending trend line drawn since May, notes SocGen.

“The daily stochastic indicator shows a positive crossover, hinting at 1.2850 as a key short-term support and the likelihood of the resumption of an overall uptrend. Only a break below would mean a deeper retracement.

The formation of an inverted H&S on hourly charts further suggests an extension in recovery towards 1.33 and probably even towards the monthly channel limit at 1.35/1.36, which remains a key level for the next leg of the uptrend,” SocGeb projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.