The Canadian dollar eventually made big gains against the greenback, with USD/CAD at critical support. Important events such as Building Permits Employment data and Ivey PMI are scheduled this week. Here is an outlook on the for the events moving the loonie and an updated technical analysis for USD/CAD.

The EU Summit gave the biggest boost the Canadian dollar, and it rose higher together with risk currencies and oil prices. The Canadian economy grew by 0.3% in April better than the 0.2% growth predicted mainly due to a boost in wholesale trade. This welcome increase is likely to affect the second quarter growth rate assumed to strengthen to 2.7% from the 1.9% recorded in the first quarter of the year. Will the Canadian growth rate trend continue?

Updates: The week begins with a national holiday on Monday, and there are no scheduled releases until Friday. After the loonie’s big surge at the end of last week, USD/CAD is trading in a narrow range. The pair was trading at 1.0167. The US will be releasing key unemployment data later in the week, and we could see the pair break out if the readings catch the market by surprise. USD/CAD continued to trade in the mid-1.01 level, as the pair was trading at 1.0157. The markets are waiting for the release of key Canadian employment data and a PMI on Friday. The loonie has edged upwards, as USD/CAD was trading at 1.0123. USD/CAD is in a holding pattern prior to the upcoming releases of key employment data from both Canada and the US, and we could see the pair break out if these figures do not match the market estimates. USD/CAD was quiet, trading at 1.0111.

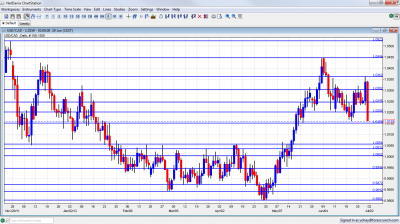

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Building Permits: Friday, 12:30. The value of building permits plunged 5.2% in April from March, way more than the 0.3% drop predicted following 4.9% gain in the previous month. The main cause for this decline was lower demand for construction intentions in Ontario. Residential sector declined 2.8% while the non-residential sector dropped 8.4%. However the annual value of building permits issues in April was 24.3% higher than in the same month last year. A further decline of 0.7% is expected now.

- Employment Data: Friday, 12:30. Canadian job creation slowed down in registered May with an addition of 7,700 jobs following an amazing boost of 58,200 jobs in April and 82,300 job leap in March. This slowdown was worse than predicted but did not come as a surprise either. The small figure was due to the addition of self-employed, government and part-time workers which offset a decline in full-time employment in the private sector. Nevertheless unemployment rate was not affected by this decrease and was kept at 7.3%. Canadian Job market is expected to gain 5,200 jobs while unemployment claims are predicted to remain 7.3%.

- Ivey PMI: Friday, 14:00. Purchasing activity expanded in May reaching 60.5 from52.7 in April while economists expected a smaller rise to 53.5. Purchasing Managers Index showed on Thursday; however the employment sub-index surprised with a decline to 46.3, the lowest level since February 2010. A decline to 55.1 is anticipated this time.

* All times are GMT.

USD/CAD Technical Analysis

Dollar/CAD traded quietly at first, and then made a surge. It bounced off the 1.0360 line (mentioned last week) before falling sharply and closing at 1.0159, just above critical resistance at 1.0150.

Technical lines, from top to bottom:

We start from lower ground this time. 1.0750 was the peak of ranges several times in the past few years, and is a very important line. 1.0660 was last seen in September 2011, but this line was also a long running swing high several times beforehand.

1.0523 was a peak back in November and is minor resistance. 1.0460 capped the pair in June 2012 and also had a minor role in the past. It is now high resistance.

1.0360 was a pivotal line in June 2012 and is now significant resistance. It proved its strength in June 2012. The round number of 1.03 was resistance at the beginning of the year and now returns to this role. It worked perfectly well during June – over and over again, until finally being run through.

1.0245 served as a separator for the move up when the pair rallied in May 2010 but is weaker now. The round figure of 1.02 was a cushion when the pair dropped in November, and also the 2009 trough. It is weaker once again after being battered lately.

1.0150 was a swing low in September and worked as resistance several times afterwards. It was challenged in June 2012. This is the key line to watch.

Just above parity, 1.0030 capped the pair twice in March 2012 but is weaker now after working only temporarily in May. The very round number of USD/CAD parity is a clear line of course, and the battle is renewed after the recent climb.

Under parity, we meet another pivotal line at 0.9950. It served as a top border to range trading in March 2012 and later as a line in the middle of the range.

0.99, the round number is now present on the graph after capping the pair in May 2012. 0.9840 provided support for the pair during September and was reduced to a minor line now.

Lower, 0.9725 worked as strong support back at the fall of 2011. The last line for now is 0.9667, which was another strong cushion in the past.

I am bearish on USD/CAD.

While the relative calm in Europe might not last (there are too many holes in the agreement), the Canadian economy continues showing signs of strength, and together with some stability from the US (Canada’s biggest market), the loonie might approach parity. The 1.0150 line is a critical hurdle.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast