Canadian retail sales and inflation figures for August come out worse than expected. Core retail sales, the most important release and focus on our preview, fell by 0.1% instead of rising by 0.5% as expected. This was only partially offset by a minor upwards revision to last month’s data: -0.6% instead of -0.8% originally reported. Headline sales also fell by 0.1%.

Inflation is not going anywhere fast: the consumer price index slipped by 0.2%, worse than a rise of 0.1% that was projected. Core inflation remained flat, not advancing as predicted.

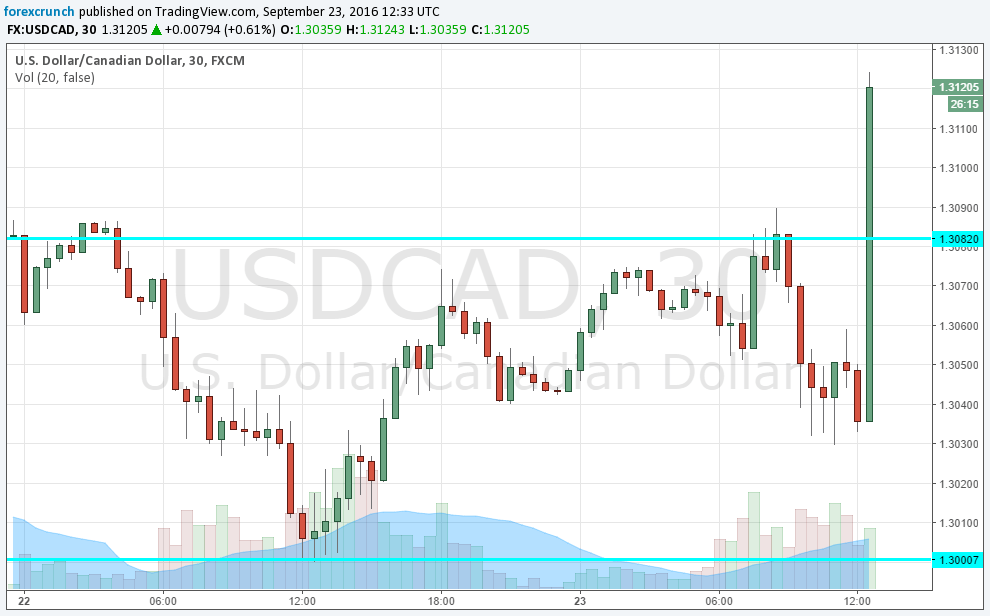

USD/CAD makes a move to the upside. The pair, that was sliding towards the publication, abruptly changed course and rose by around 90 pips: from 1.3035 to 1.3125. It trades at 1.3115 at the time of writing.

The Canadian dollar had enjoyed the rise in oil prices earlier in the day. Talk about a deal between Iran and Saudi Arabia on limiting oil production hit the airwaves and defied the low expectations for any kind of agreement. Needless to say, we still do not have a deal. In addition, a deal depends on its implementation and even if everything goes to plan, supply from the Middle East can be countered by a ramp-up in US shale production.

In any case, USD/CAD is now trading in higher range. Resistance awaits at 1.3140, followed by 1.3220. Support is at 1.30.

More: USD/CAD En-Route To 1.37; CAD: Slipping Further Down US Trade List; – CIBC