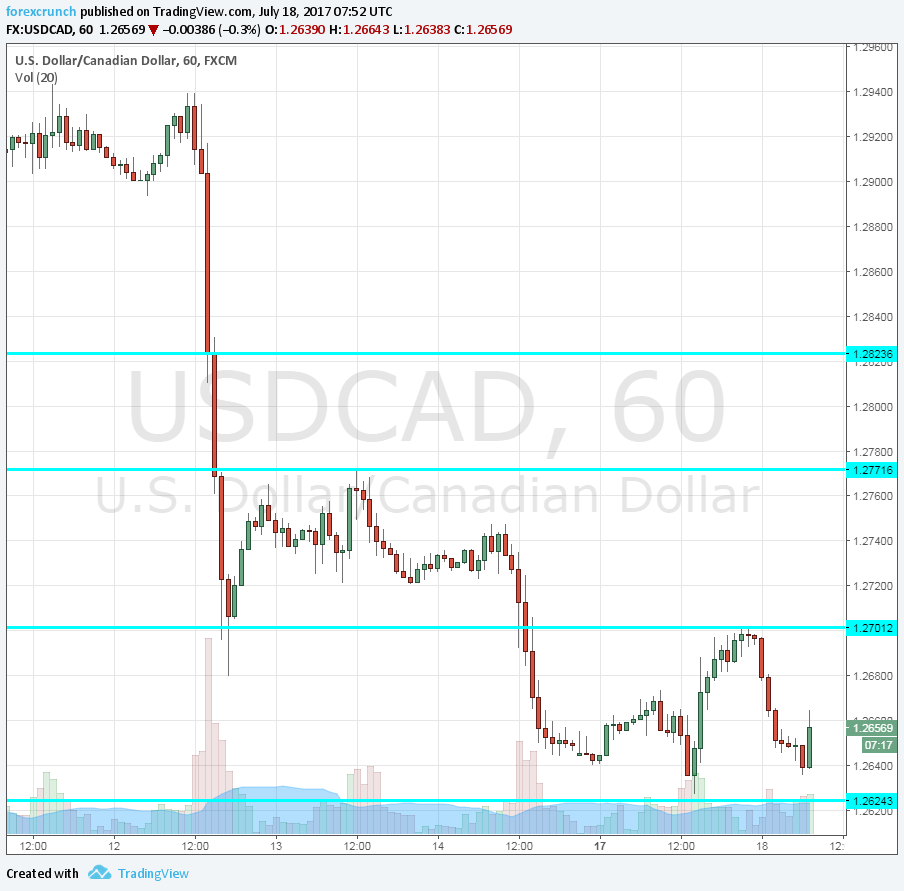

Last week, Dollar/CAD dropped sharply as the Bank of Canada made its hawkish hike and also on USD weakness. That drop in the greenback was fueled by Yellen’s caution on inflation, weak inflation data and the travails of Trump Junior.

The most recent fall comes from politics, but not from Trump. Senate majority leader Mitch McConnell is forced to abandon his attempt to pass a new health care bill. More Senators have announced they will reject the amended bill.

The failure casts doubts about tax reform and infrastructure spending and weighs on the dollar. USD/CAD, which saw a correction after the big falls, is seeking lower ground.

USD/CAD ranges and levels

After trading between 1.27 and 1.2770, the pair is now in a lower range, 1.2625 to 1.27. These remain the lowest levels since May 2016. Back then, the low was 1.2460. A fall below 1.2460 would already send the pair to an area where the pair traded in June 2015, over two years ago.

What’s next for the Canadian dollar? Apart from the weekly oil inventories on Wednesday, the loonie faces another figure: manufacturing sales, also on Wednesday. The bigger test comes on Friday. Canada releases inflation and retail sales figures which will determine the next moves of the Bank of Canada.