Dollar/yen fell to levels last seen on February 14th, continuing the weekly slide. The pair which behaves in the best manner to US indicators is undoubtedly pricing in an announcement of QE3 from the Federal Reserve.

At these levels, a potential disappointment will likely reverse this trend. What will happen if Bernanke indeed announces QE3? We could get the exact same reaction – sell the rumor, buy the fact. Time for USD/JPY Long?

Update: Fed Announces QE3: $40 Billion in MBS, Open Ended, Low Rates Through 2015

More: EUR/USD is flirting with uptrend support ahead of the Fed

The pair is impacted strongly by US indicators: the yen gains on worse US indicators and rising expectations for QE3. It falls on better US indicators and when QE3 is played down. In addition, trouble in Europe helps the safe haven yen and when things get better in Europe, the yen gains.

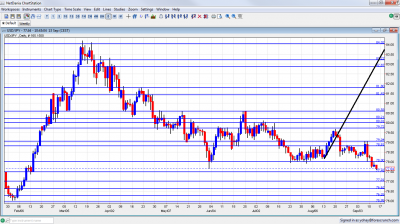

Recently, European hope weakened the yen and USD/JPY made a temporary rise to 79. However, the rising expectations of QE3, especially after the weak NFP, had a stronger impact.

As we get closer to the event, the pair broke lower and even fell below the 77.65 low seen in June. USD/JPY broke below support at 78 that held it since mid July and fell as low as 77.58. Support is at 77.48.

Sell the rumor, buy the fact?

It often happens that events are so priced into the market, that when the event happens, a move in the opposite direction is seen, regardless of the outcome. This is a classic “buy the rumor, sell the fact”.

In this case, it is important to mention that the Japanese authorities are not happy with the strong value of the yen: they have already upped their rhetoric about intervention once again. While Japanese interventions haven’t been effective in the long run, they still tend to rock the markets in the short term.

In addition, the BOJ often intervenes in a “stealth mode” – without announcing it. And, the fear of intervention also moves the markets.

If the Fed doesn’t deliver QE3, but rather goes for extended guidance concerning interest rates, the disappointment will see the dollar surge across the board, and the yen will not be spared.

Further reading: QE3 Now? Really?