Dollar/yen tested the lows but remained stable as Comey’s testimony was politically explosive but lacking any immediate implications. The next big mover is the Fed decision. Here is an outlook for the key levels to watch on the pair with a note of key movers.

This is a new format of the outlook and feedback is welcome. We cover the top fundamental news and outlook, a technical analysis on the daily chart and finally sentiment for the pair moving forward.

USD/JPY fundamental movers

USD/JPY managed to advance when Comey’s testimony was released. The former FBI Director painted a bleak picture of Trump’s behavior, demanding loyalty and intervening in the Russian investigations. However, Comey stopped short of declaring it was an obstruction of justice. This triggered some “risk on” sentiment – a selling off of the safe have yen.

The big event this week is the Fed decision. Yellen and co. are projected to raise rates despite a slowdown. The reaction depends on the Fed’s tone and future intentions about rates and the balance sheet. See all the main events in the Forex Weekly Outlook

In general, $/yen hardly moves on Japanese events. One event does stand out and that is the rate decision of the Bank of Japan. Some expect the BOJ to begin communicating a potential future end to the current bond-buying scheme. Back in September 2016, Kuroda and his colleagues decided to target 10-year yields. However, the BOJ convenes 14 times a year and rarely makes big decisions. Will this decision provide a surprise?

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

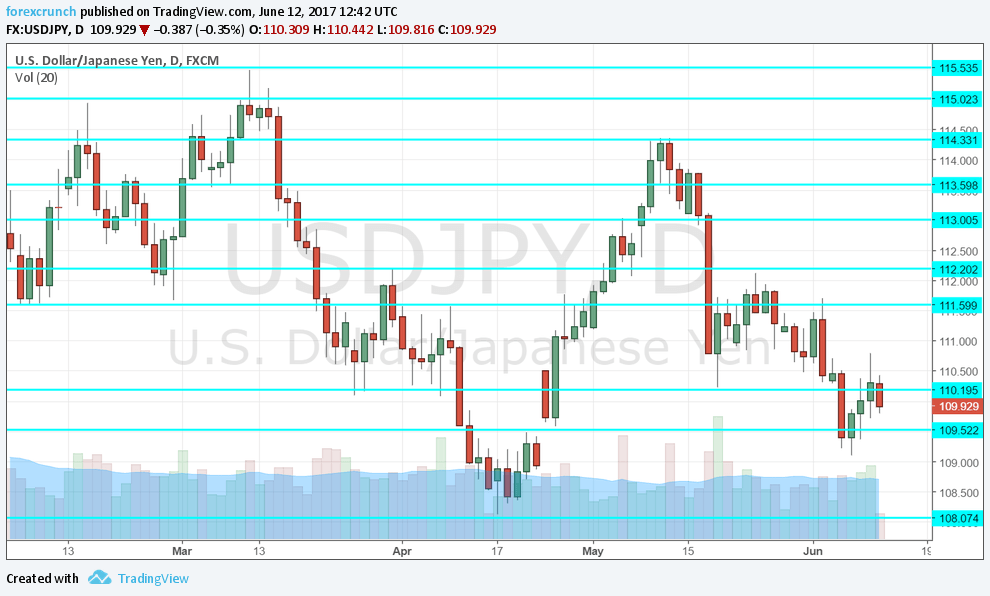

The current range for the pair is the wide area between 109.50 to 110.20. 110.20 was a swing low in May and 109.50 was the gap line in April.

Looking up, 112.20 is resistance after capping the pair in April and in May. It is followed by the round level of 113, which was a stepping stone on the way up. Further resistance is at 113.60 which served as resistance in the past.

The cycle high of 114.30 is a strong level of resistance, the highest since March. Further above, 115 and 115.35 are notable.

Looking down, 109.50 was a gap line in late April, a gap that was never closed. Further below, the cycle low of 108.10 is of high importance. Looking lower, we are back to levels seen in November, but the door is basically open to 105.

USD/JPY Daily Chart

USD/JPY Sentiment

A rate hike by the Fed is fully priced in, leaving room for disappointment. On the other hand, markets have already accepted that fiscal stimulus is not coming anytime soon from the Trump Administration. A surprising move on tax reform could boost the pair while a dovish outlook from the Fed could push it down.

All in all, the trend remains to the downside.

More: USD/JPY: Testing The Bottom Of The Trump Range; Whats The Trade? – SocGen