USD/JPY made a sharp turn-around after Trump’s Triumph and the pair now tops 108. The BOJ must be delighted. The team at Bank of America Merrill Lynch sees further gains:

Here is their view, courtesy of eFXnews:

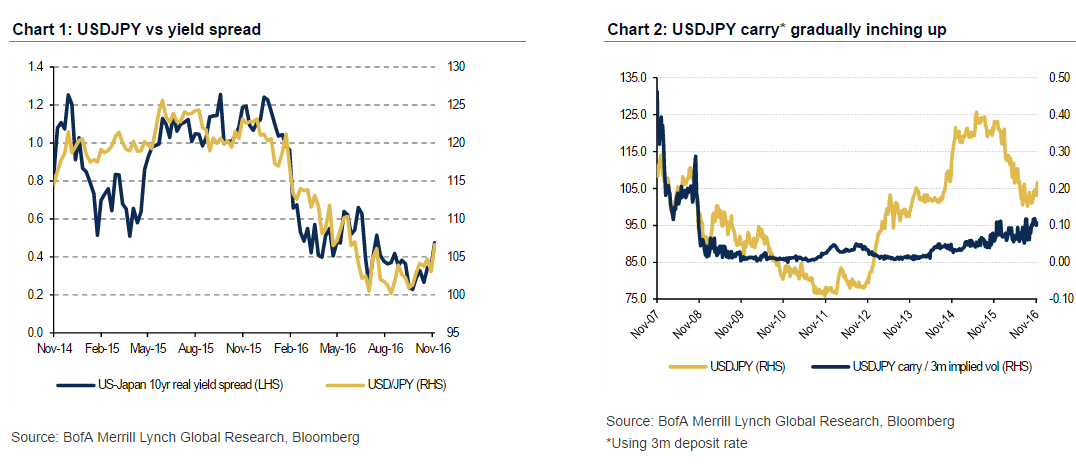

While we had acknowledged the risk of the “final JPY strength” this autumn on the BoJ’s limit and US elections, it has been our view that the USD/JPY’s dips was to be bought as the 100-105 level was where medium-term directional risk was likely to reverse to the upside.

In our view, a Republican sweep would first lead to JPY strength on risk aversion, but eventually be the most bullish outcome for the USD/JPY.

The price action last week – a shallow dip – tells us two things about the USD/JPY.

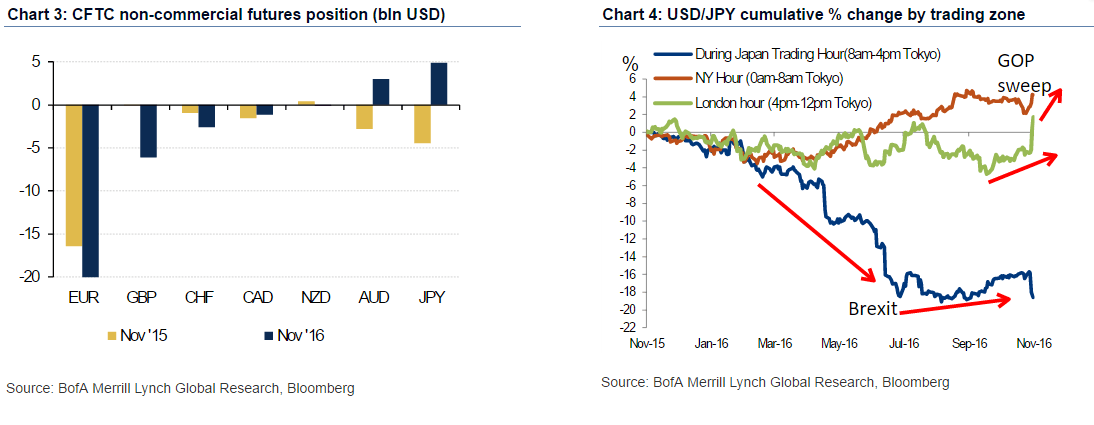

First, the view that a GOP sweep would boost the USD/JPY was probably more widely shared than we had thought, so a dip failed to stretch.

Second, there may be more potential USD/JPY buyers than sellers, which is in stark contrast to last year, when there were many more potential USD/JPY sellers than buyers (Case for a stronger yen in 2016 18 December 2015).

The “buy-on-dip” cycle in USD/JPY is likely to continue as we expect the pair to reach 115-120 by end-2017. We remain constructive about Japanese equities and see banks, insurance continue outperforming REITs near-term.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

JPY sellers > JPY buyers. While uncertainty is high, what is more certain is that there are more potential sellers of JPY than its buyers. This is the opposite of the situation some months ago.

First, CFTC speculative position remains yen long though short-term traders are probably positioned for the upside already.

Second, we believe domestic activity to raise hedge ratio has run its course as the USD/JPY swept through the sensitive level this year. As 2HFY16 (Oct ’16-Mar ’17) has started, most life insurance companies are reportedly inclined to increase exposure to unhedged foreign bonds though they generally remain price sensitive. In our view, this is reflected in the USD/JPY’s consolidation during Tokyo trading hours after the pair hit 100 on the Brexit vote.

The fact that USD/JPY has failed to break 100 multiple times since then suggests the market looking for USD/JPY’s dip, light positioning, and the market’s judgment that USD should be more expensive than 100 JPY. The market is probably more vulnerable to the USD/JPY’s upside than downside.