Dollar/yen seems unstoppable, with the pair already looking at 115. Can this last? The team at Barclays sees an imminent correction:

Here is their view, courtesy of eFXnews:

The recent yield -driven USD rally since the US election appears extended as we see limited scope for further uptrend in UST yields without more policy clarity. While president -elect Trump’s fiscal policy stimulus is expected to boost growth from late 2017, the US economy is poised to decelerate into H1 17 due to tightening financial conditions and potential negative effects from antiglobalization policies, such as tariffs on China and Mexico, in our view.

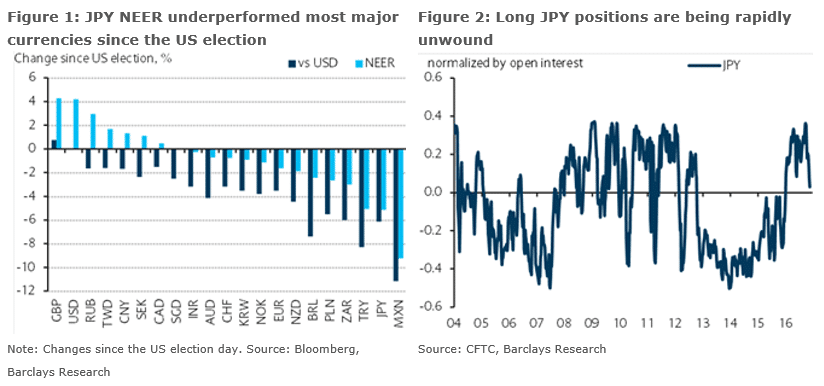

Amid such backdrop, we have pushed back our forecast for the next Fed hike in 2017 (after one hike in December 16) to September from June. In terms of longer -end UST rates, our forecast of 10y UST yields stand at 2.25% in Q1 and 2.40% in Q2 Q4, suggesting that further near -term yield driven USD appreciation should be limited. Amid the post -election USD rally, the JPY has underperformed almost all major currencies except a few EMs, such as MXN.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Consequently, the JPY NEER has declined nearly 6% in three weeks (Figure 1). The pace of the post -election USDJPY rally (month todate) is the fastest since November 2014 following the BoJ’s QQE expansion and the GPIF announcement of its portfolio rebalancing plan. There have been three main drivers of JPY’s underperformance: 1) yield differentials: the main driver of the post- election move, in our view, with BoJ’s yield curve control (YCC) reinforcing US Japan yield differential widening by keeping JGBs relatively immune from global bond selloff; 2) risk dynamics: supportive of JPY weakness despite tightening financial conditions by reducing safe -haven demand for the JPY; and 3) positioning: accelerator of the move with a rapid unwinding of speculative JPY long positions, which seems to have largely run its course. In fact, CFTC non- commercial net long JPY positions have already been mostly unwound (Figure 2).

All three factors have contributed to a rapid USDJPY rally with the pair now trading more than 2 standard deviations overvalued according to our FFV model, suggesting that a near term correction is likely imminent.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.