Dollar/yen was driven by the Fed and extended its gains, while yet another round of threats between the US and North Korea cooled down the rally. The pair is in the middle of the well-known range. Can it break to either direction?

USD/JPY fundamental movers

Fed hawkishness, North Korea again

The Federal Reserve announced the beginning of its undoing of QE: reducing the balance sheet. This was well-telegraphed and did not cause a stir. However, the Fed also left its dot-plot unchanged, implying a rate hike in December and 3 more in 2018. This sent the pair to higher ground, above 112.

Nevertheless, Yellen characterized the low inflation in 2017 as a “mystery” and there are more reasons why a December hike is still in big doubt. The greenback did not go too far.

The tensions with North Korea remained center stage for another week. Trump threatened to “destroy” the rogue regime if necessary. He also added sanctions. North Korea reacted by threatening to escalate the actions, including a potential test of a hydrogen bomb in the Pacific Ocean. As usual, these flare ups send money into the safe-haven yen.

Another story that has been making the rounds is the probably snap election in Japan on October 22nd. Prime Minister Shinzo Abe wants to take advantage of the opposition’s disarray to reinforce his political strength. The same happened in 2014.

Final US GDP, Japanese inflation

The last week of Q3 features the CB consumer confidence, durable goods orders and the final GDP read in the US. Also worth mentioning, we find the Fed’s favorite inflation measure: the core PCE Price Index.

In Japan, we get the inflation figures, which are expected to remain low, as always.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

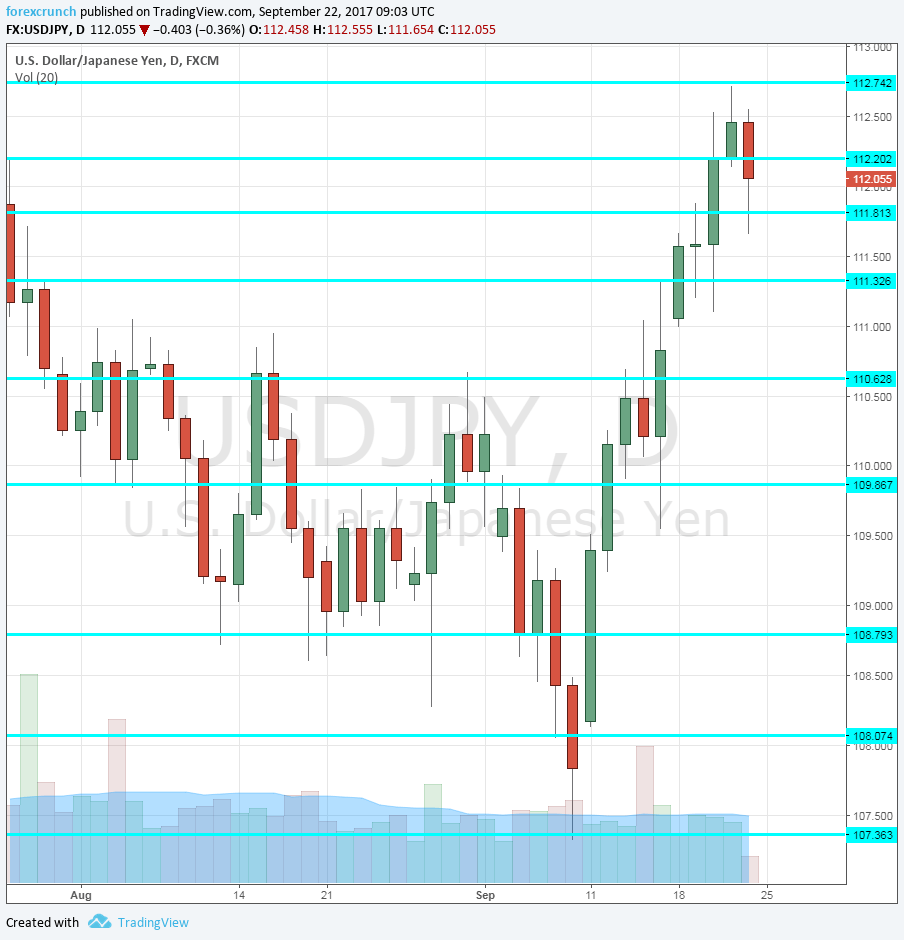

113.50 was a temporary line of resistance on the way up in July. 113.70 was a separator of ranges in June.

112.20 used to be important in the past. It is closely followed by 111.80, which capped the pair in May. The swing high of early September at 111.30 serves as another point of interest.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance.

The trough of 107.35 seen in early September serves as another cushion on the way down.

Looking lower, we are back to levels seen in November, but the door is basically open to 105.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

Doubts about the Fed’s rate hike could continue weighing on the dollar. In addition, the situation around North Korea is increasingly worrying.

Our latest podcast is titled Fed mysteries and dismissing missiles

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!