The Japanese yen posted weekly gains for a third straight week, as the pair closed slightly above the 101 level. There are only four events on this week’s schedule. Here is an outlook for the highlights of this week and an updated technical analysis for USD/JPY.

Japan’s current account widened sharply in July, beating expectations. There were no other Japanese key releases, but further details about the government’s large stimulus package helped push the yen upwards. Late in the week, the yen took advantage of soft retail sales and wholesale prices in the US, posting strong gains late in the week.

do action=”autoupdate” tag=”USDJPYUpdate”/]

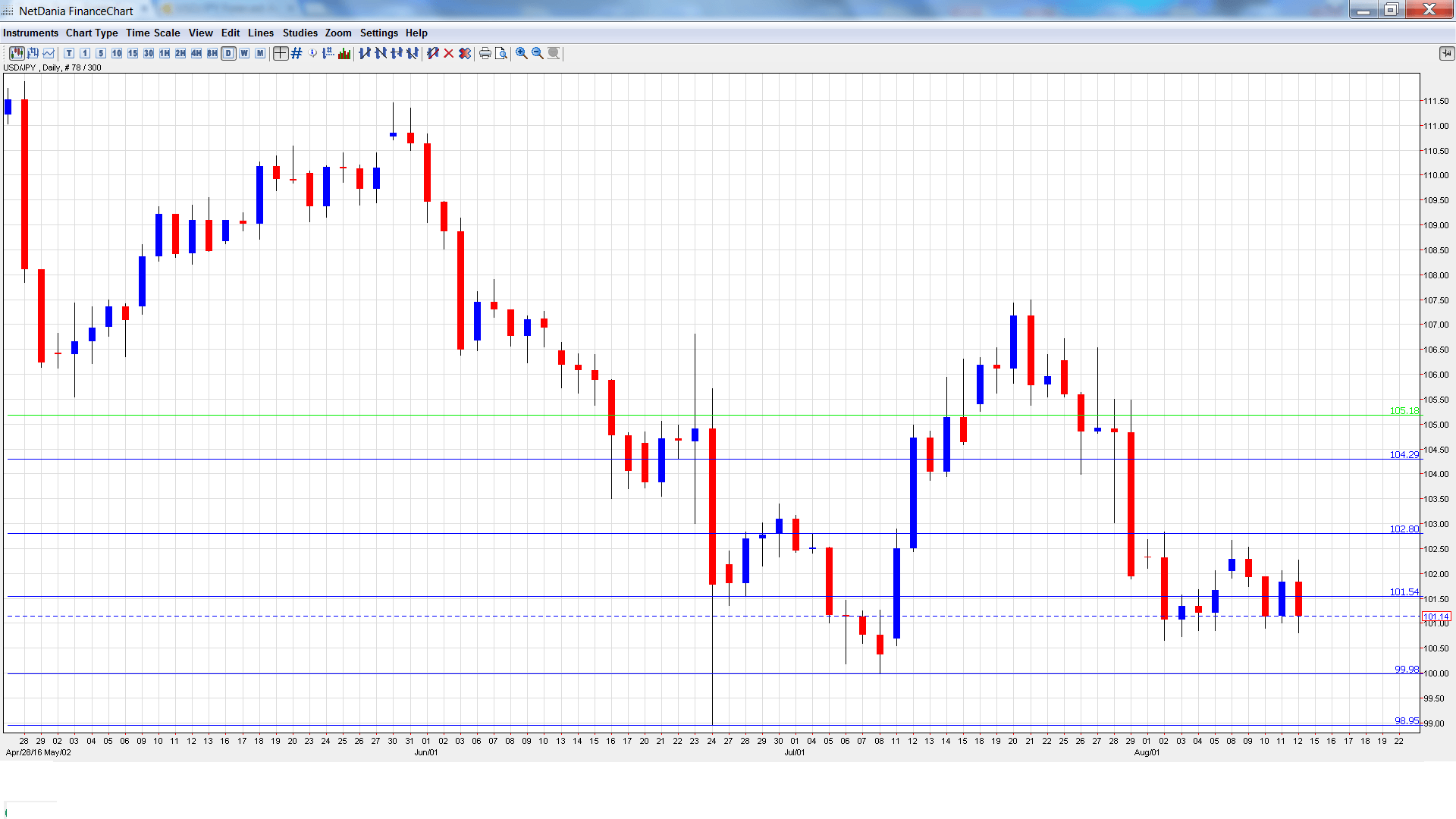

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- Preliminary GDP: Sunday, 23:50. This is the key event of the week. Final GDP in the first quarter climbed 0.5%, matching the forecast. Preliminary GDP for Q2 is expected to be softer, with an estimate of 0.2%.

- Revised Industrial Production: Monday, 4:30. This manufacturing indicator declined 2.6% in May, missing expectations. The indicator is expected to rebound in June, with an estimate of 1.9%.

- Trade Balance: Wednesday, 23:50. Japan’s trade surplus improved to JPY 0.33 trillion in June, beating the forecast of JPY 0.24 trillion. The surplus is expected to drop sharply in July, with the estimate standing at JPY 0.14 trillion.

- All Industries Activity: Friday, 4:30. This minor indicator declined 1.0% in May, matching the forecast. The markets are expecting a rebound in June, with an estimate of a 0.9% gain.

* All times are GMT

USD/JPY Technical Analysis

USD/JPY opened the week at 102.04 and quickly touched a high of 102.66, as resistance remained firm at 102.80 (discussed last week). The pair then reversed directions and dropped to a low of 100.81. USD/JPY closed the week at 101.14.

Live chart of USD/JPY: [do action=”tradingviews” pair=”USDJPY” interval=”60″/]

Technical lines from top to bottom:

105.19 was a cushion in October 2014.

104.25 is next.

102.80 held firm as the yen weakened early in the week before rebounding higher.

101.51 has switched to a resistance role following sharp losses by USD/JPY.

99.98 is next.

98.95 has held in support since late June.

97.61 was last tested in November 2013. It is the final support level for now.

I am bearish on USD/JPY

With the US posting weak numbers last week, a September rate hike from the Fed is likely off the table. Investors could look to the safe-haven yen, especially as the Japanese currency continues to improve and could make a push towards to symbolic 100 level.

Our latest podcast is titled Carney King of Governors, Small in Japan

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast