Dollar/yen attempted to move above the cycle high but was rejected. On its way down, it lost the uptrend line of support. The drivers were both political and monetary.

Is this the beginning of a downturn or a necessary correction on the way up?

USD/JPY fundamental movers

Donald Junior and Janet Yellen

Donald Trump Junior is in trouble for meeting with the Russians regarding damaging information about Hillary Clinton. The data has not been denied and is seen as a smoking gun. Contrary to some of the previous market reactions, this time the dollar reacted negatively.

Yellen’s prepared statement contained elevated concern about inflation, which the Fed monitors “very closely”. Her Q&A session already contained a more balanced tone. While the reaction was uneven, the dollar slipped against the yen.

But what really hurt the greenback was the data. Inflation and retail sales figures missed expectations and sent the dollar down.

In Japan, the BOJ continued buying bonds that markets sold off. The result is more yen printing. The Tokyo-based institution continues being the most dovish central bank in the developed world.

The issues around North Korea have cooled down, at least for now.

Housing data, BOJ decision

The upcoming week features housing data from the US: building permits and housing starts. Also, watch the Philly Fed Manufacturing Index. Echoes from Yellen’s testimony and the inflation report will likely reverberate.

In Japan, we have a rate decision by the BOJ. Kuroda and co. are unlikely to change their current policy of holding long-term 10-year yields to 0%. The assessment of the economy and mostly inflation will set the tone. The previous BOJ meeting did not yield volatility, but you never know.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

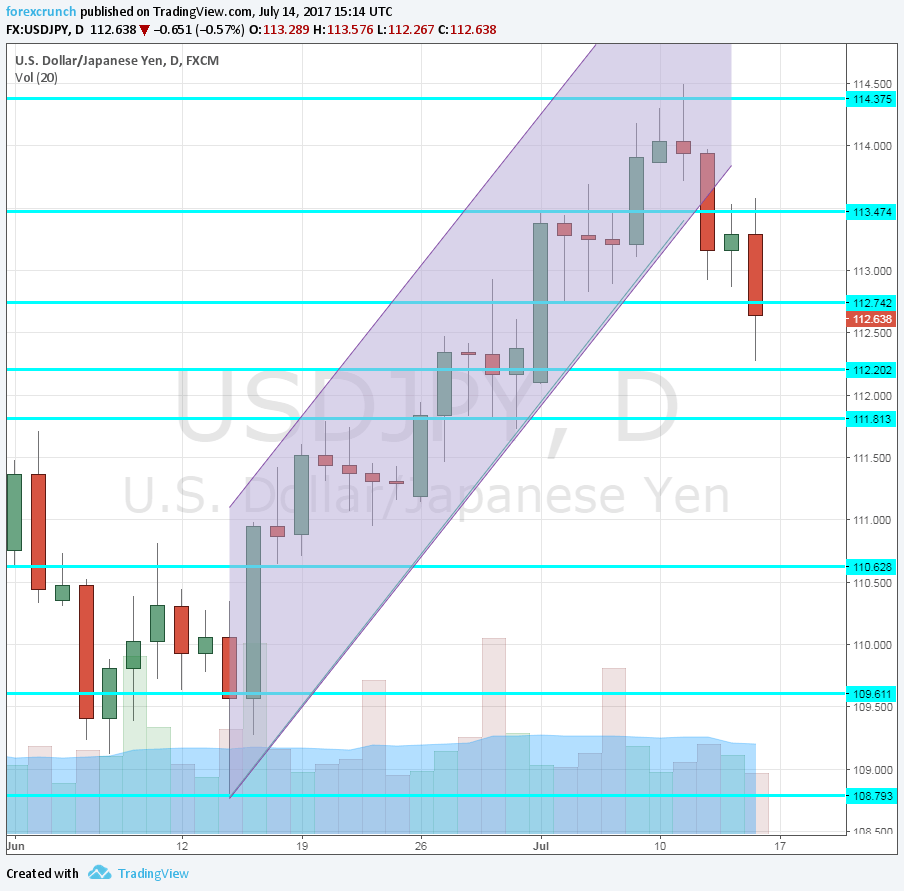

115.35 is the next line of resistance in case the pair break the cycle high of 114.30 which remains critical resistance after capping the pair back in May. The break to 114.50 did not go very far.

113.50 was a temporary line of resistance on the way up in July. 113.70 was a separator of ranges in June.

112.20 used to be important in the past. It is closely followed by 111.80, which capped the pair in May.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance. Looking lower, we are back to levels seen in November, but the door is basically open to 105.

Steep Uptrend Support – broken?

The pair slipped off the steep line of uptrend support. It was probably too hard to ride the tiger. Is this a bearish sign? Or just correction and the pair will find another line to ride on?

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

The pair enjoyed too much hot air and not enough substance. The balanced tone of the FED could allow for another week of falls.

Our latest podcast is titled Yellen is not loving it, markets do