Core CPI y/y came out at 1.7% as expected but all the other data figures disappointed. Month over month, prices are flat, core CPI is up only 0.1% m/m. Retail sales fall 0.2% and so do core sales. The biggest disappointment is the control group which is down 0.1%. The average earnings data attached this report is slightly higher, but recent NFP wage data was a miss.

The US dollar is tumbling down across the board.

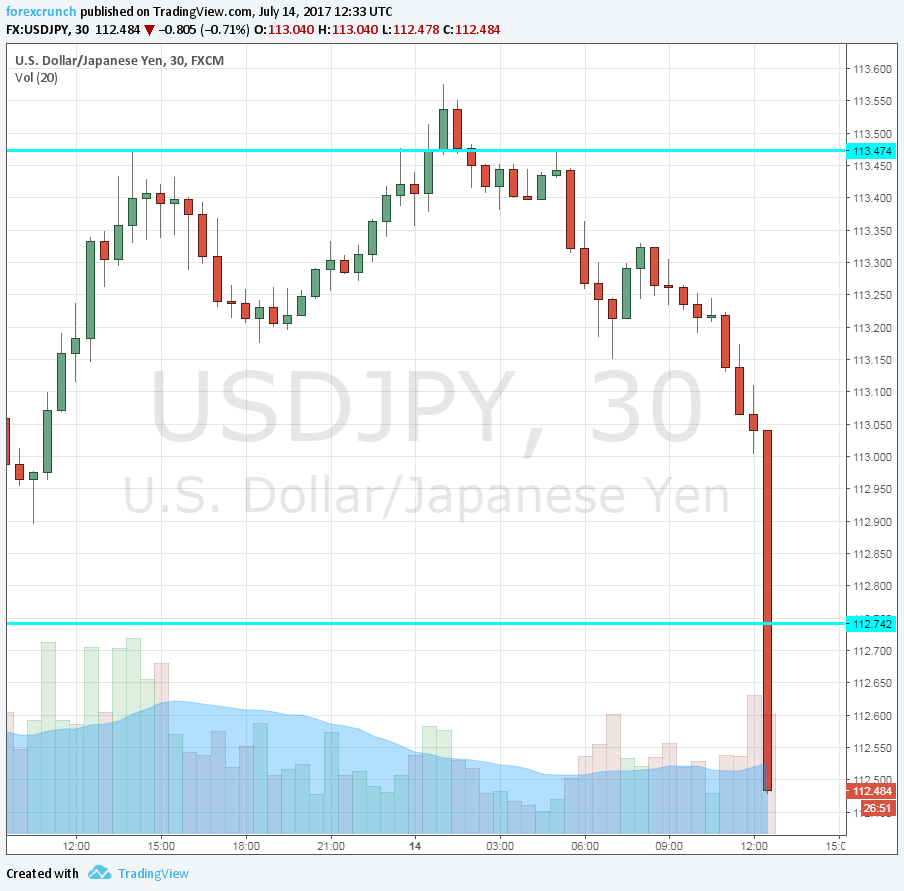

- USD/JPY, charted below, is down over 50 pips to around 1.1250. Dollar/yen recently slipped under uptrend support.

- EUR/USD is up to 1.1440. The euro is somewhat encouraged by Draghi’s upcoming speech.

- GBP/USD is flirting with 1.30 despite all the UK troubles.

- USD/CAD is under 1.27 once again, still enjoying the hawkish hike.

- AUD/USD is getting close to 0.78. It has China to rely on.

More:

June inflation and retail sales data (updated)

- CPI m/m: previous 0.1%, expected +0.1%, actual: 0%

- Core CPI m/m: prev. +0.1%, exp. +0.2%, actual: 0.1%

- Core CPI y/y: prev. 1.7%, exp. 1.7%, actual: 1.7%

- CPI y/y: prev. 1.9%, exp. 1.7%, actual: 1.6%

- Retail sales: prev: -0.3%, exp. +0.1%, actual: -0.2%

- Core retail sales: prev. -0.3%, exp. +0.2%, actual: -0.2%

- Retail control group: prev. 0%, exp. +0.3%, actual: -0.1%

Earlier this week, Fed Chair Janet Yellen testified and tried to keep things quite balanced. However, she did say that the Fed is monitoring inflation closely. Some of her colleagues seem concerned about inflation and the lack of growth in wages.

However, the Fed is still en route to begin reducing its balance sheet in September and to raise rates once again in December.

More: Fed Yellen’s Testimony: Uncertainty About Inflation A Signal Of Slower Pace Of Further Hikes – ABN AMRO

We later get industrial output and consumer confidence.

Data background

The US was expected to report a small rise of 0.1% in retail sales and 0.3% in the retail control group. Core inflation was expected to remain at 1.7% y/y.

The focus this time was on core CPI. While inflation is slowing down, the Fed is somewhat reluctant to change course.

The dollar was mildly on the back foot ahead of the release. USD/JPY was around 113, EUR/USD at 1.1415, GBP/USD was higher at 1.2975, USD/CAD took a break around 1.2720 and AUD/USD continued its rise to 0.7760.