Dollar/yen ticked lower in the last week of 2011. Will the yen continue strengthening in 2012? The first week doesn’t feature any significant economic indicators, so the outlook is mostly technical.

Most economic indicators disappointed in Japan in the past week, and show that the country still has a way to go after the March 11 disaster. The currency hasn’t followed the economy so far, but this might change now.

Updates: Dollar/yen continues lower after some optimism came from Europe and after China’s PMI exceeded expectations. Stronger manufacturing PMI in the US counters the weak commitment from the Fed regarding rates. All in all, USD/JPY is struggling with 76.76 once again..Dollar/yen reversed course and climbed above resistance at 76.76. Japan hinted about fresh interventions.

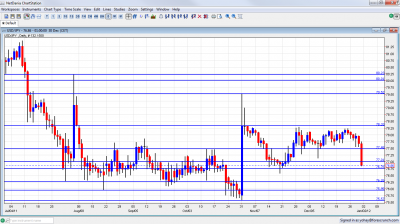

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

* All times are GMT

USD/JPY Technical Analysis

Dollar/yen has a relatively active week for the recent period. After remaining in the 77.50 to 78.30 range (mentioned last week), the pair fell sharply and closed the year at a very low level 76.86.

Technical lines from top to bottom

80.25 was a swing trough in June and a peak in July. The round figure of 80, which provided strong support, is the next line, and it is of high importance.

79.50, is the next line of resistance. This is the line that was reached after the recent intervention. 78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. This is the key line on the upside for now.

77.50 is now stronger once again, and now works as resistance. It worked well also in October. The round number of 77, is a significant cap once again, after the recent fall. It’s followed closely by 76.75 after providing strong support of late., including at the very end of 2011.

Further below we have the swing record low of 76.25 which is still of importance after working well as resistance. A previous low of 75.95 is minor support. The last record low of 75.57 where the BOJ intervened is the final frontier in charted territory for now.

Below, the round number of 75 is the next potential cushion and an area where the Japanese authorities will be keen to intervene.

I am bullish on USD/JPY.

The recent Japanese figures are worrying, while US figures remain encouraging. After year-end adjustments are behind us and as market participants return in full blast, the pair has room for rises. European troubles have a diminishing impact on the pair.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.