Japan reported its preliminary GDP report for Q2, and it was great: 1% q/q growth rate, equivalent to around 4% annualized. This is a very high growth rate in a developed country. Expectations stood at around 0.6% and Q1 saw only 0.3% growth.

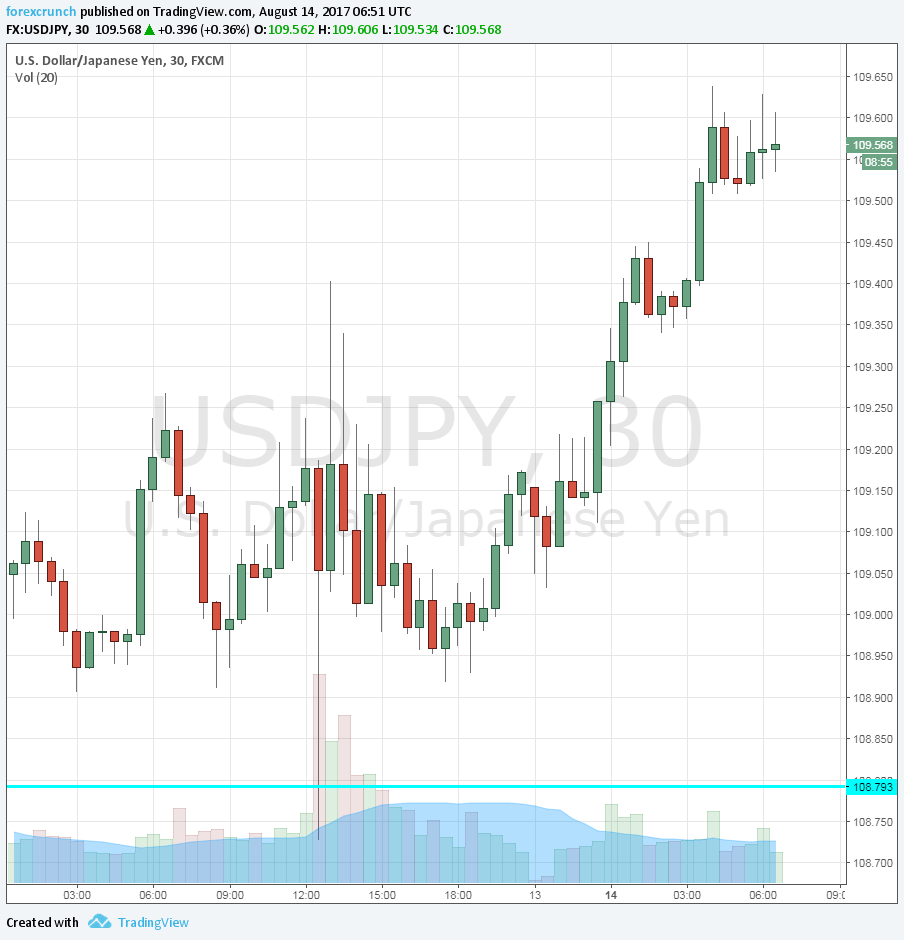

But USD/JPY is actually on the rise, trading around 109.55 and getting away from support at 108.80. Why?

One reason lies within the GDP report. The real growth rate is based on a slower nominal growth rate. The GDP Price Index, aka “deflator” in the US, is down 0.4%. The Bank of Japan targets inflation, and inflation is not going anywhere fast.

The second reason why USD/JPY is not falling stems from the safe-haven nature of the yen. Last week, the Japanese currency gained thanks to growing tensions with North Korea. Threats of “fire and fury” by Trump were countered by the rogue regime’s own menaces. The yen enjoyed its traditional flows in times of troubles.

Has anything changed around North Korea? Not really, but the attention span is short and it has moved elsewhere. The terror attack in Charlottesville by neo-nazis and Trump’s lack of an adequate response to it dominated the news. North Korea is on the back burner.

The domestic issues of the US do not impact the yen like geopolitical events. So, USD/JPY finds the path of least resistance: up.

Will this continue? Not necessarily. The US has its share of weak inflation data and the greenback is quite vulnerable. Another disappointing number from America can send the dollar and dollar/yen down.