The Bank of Japan does not like excessive foreign exchange moves, especially when their currency strengthens. So does Japan’s Ministry of Finance. Nevertheless, the markets seem fearless of the Japanese authorities.

The BOJ did not make any policy changes in its June decision, adopting a wait-and-see mode like other central banks. The result is an extension of existing trends: a stronger Japanese yen on safe haven flows, the result of Brexit fears. In addition, some of the troubles originate closer to home, from China, at least according to policymakers in Tokyo.

This comes on top of an extremely cautious Fed decision: the world’s most important central bank made no policy changes and also sent a dovish message. The prospects for rate hikes fell once again, and here are 5 reasons for that.

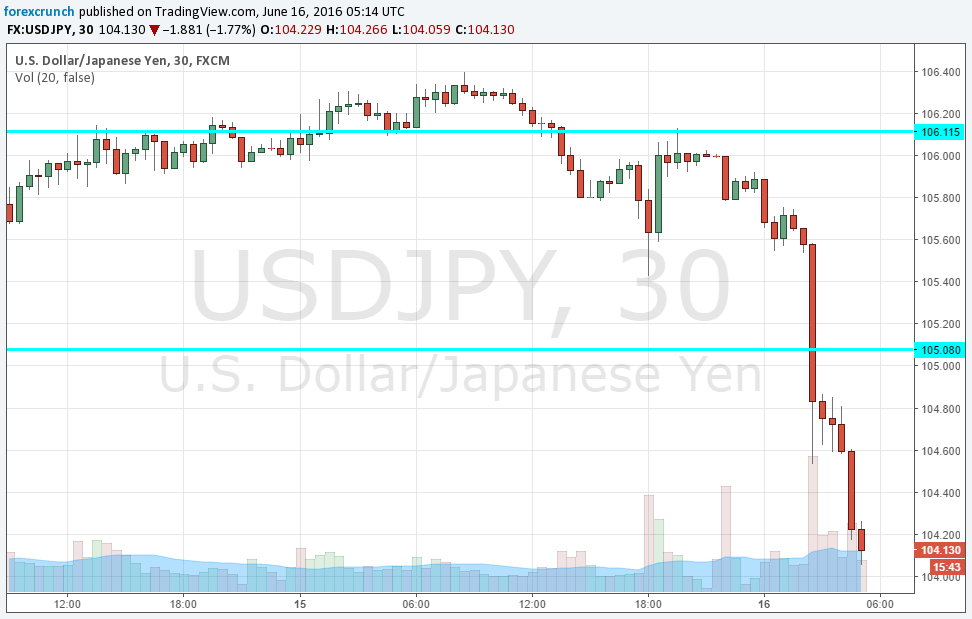

So, USD/JPY extended its falls below 105.50 that supported it recently. After the battle was won, the 105 was pierced through quite rapidly and 104.01 is the low at the time of writing. We are back to levels last seen in 2014, before the second round of QQE announced by the BOJ.

We may be on the cusp of another huge monetary stimulus wave, with helicopter money coming in the chopper. However, the BOJ awaits the verdict of the British voter before taking further action.

Resistance is at 105.50, followed by 107.65. Support is at 104, which seems temporary, and the next levels are a fallback to 2014.

Here is the dollar/yen chart: