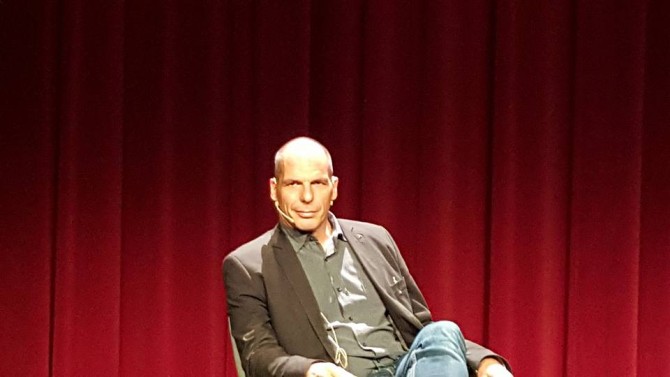

Ex Greek finance minister Yanis Varoufakis is speaking in Barcelona about democracy in Europe following the events that rocked his country and the euro-zone.

He is talking in the Centre Cultural El Born in the old part of the Catalan capital. Here are highlights of his talk:

Update: Live blog of his appearance in Barcelona on June 1 2016

Thousands of people were waiting in line outside the conference center.

- The common currency was constructed like the gold standard

- The Europeans are sighting with each other.

- In the US, each crisis brought the Americans closer together and in the euro-zone the opposite is happening.

- The euro-zone was wrongly constructed.

- The state’s role was to keep the different classes in equilibrium/

- The EU has its roots in a cartel of coal and steel, and later came other cartels.

- The Eurogroup is a democracy free zone.

- The European Parliament is a very interesting building but not a real parliament.

- In Greece, we suffered the greatest depression since the 1930s.

- Only 9% of the unemployed get unemployment benefits.

- The Eurogroup told me that nay program is a good program as long as it is this specific program they originally designed.

- In the 60s they used tanks, now the banks.

- We were threatened with the closure of the banks and people still voted NO.

- Tragically, our government decided to surrender.

- We did a lot of damage to other left wing European parties.

- In Brussels, the truth comes out when microphones are closed.

- In Spain, you rescued the banks and paid with austerity.

- When you have different economies and put them together, you have a tsunami of money from surplus countries like the northern ones to the southern countries.

- This flow of money comes in the form of loans.

- In Spain, it came through developers building houses and people felt rich.

- In Greece, the money went into the state sector. The government built high highways, Olympic stadiums and corruption.

- Everything came from borrowed money from Germany.

- It had to be borrowed because that’s how it works.

- When the music stopped, Spanish developers went bankrupt, then the banks and then the state.

- In Greece, the state suffered but the result was the same: austerity.

- In the US, the Federal Government stood behind failing banks in states.

- Break down the unholy alliance with external bankers.

- A banker must know that if the bank goes bankrupt, the banker goes home.

- Public debt crisis: In Spain, there is a state crisis because of the banks.

- In the US, the Federal Government takes over. In the euro-zone we need proposals that are relevant

- We split the state debt like this: 60% of national debt, blue / good debt. The rest is red / bad debt.

- Each country stay with the red debt but Europeanize the blue debt.

- From now on, the ECB services the good debt on behalf of the national state.

- So, the ECB operates as a go between the state and the money markets.

- We benefit because the ECB has a good name and it can borrow at near 0% interest rate.

- So, 40% of total euro-zone debt just goes away without anybody losing money – the interest rate becomes zero.

- There is a constant conflict between the ECB and the Bundesbank.

- The Bundesbank took the ECB to court.

- The mere announcement of this scheme could make the debt crisis would go away.

- On Investment: the lack of investment shows us that there is a big problem in Europe.

- A lot of debt means a lot of accumulated money. Too much money.

- The rich people in Europe have more money than ever.

- The money is stuck.

- Interest rates are below zero. In bonds and shares there’s risk and the mattress is not large enough.

- German pension funds don’t have where to invest the money because of negative yields.

- The solution would be to invest in productive things, including green causes.

- The problem is that if money is invested, nobody will be able to buy the goods – a vicious cycle.

- To break and kickstart, you need to guarantee this with the state. The southern states are bankrupt.

- France is bankrupt.

- France is required not to overspend from Germany.

- The European Investment Bank could ignite investment in green energy.

- There is no political will behind the EIB which belongs to all of us.

- If the ECB would have bought investment bonds and not state bonds and they have the right to do that according to the charter.

- The ECB could buy EIB bonds.

- When rich people will see this investment, other investors will jump in and that will kickstart the whole economy.

- The model is the US in the 30s.

- China saved Europe in 2008. The Chinese government cranked up the machine in 2008. China’s investment ratio has been 50% – unprecedented.

- Germany managed to survive thanks to China.

- The Chinese knew that they were buying time – 5 years to create demand.

- But we haven’t done anything.

- Now China is deflating while Europe is nowhere near recovering.

- The current situation is a gross failure of the euro-zone.

- The Eurogroup is not distinguished by intellect. They just repeat the rules and don’t accept changing the rules.

- Luis de Guindos is a very clever man.

- In the Eurogroup de Guindos had only the mantra.

- Schäuble is a very enlightened man but also repeating the rules mantra without challenging the rules.

- Eurogroup: The whole is far less than the sum of the parts.

- We should be ashamed of the level of poverty and also on treating refugees.

- Poverty is a political issue, and aids the rise of the extreme right.

- If Draghi were to write a check to every poor family, it would be great, but the ECB is forbidden to do that.

- When a Spaniard buys a Volkswagen, the money goes from the buyer to the central bank in Madrid and this says in turn to the Bundesbank: send money to VW.

- So, what actually happens is that the Spanish central bank owes money to the German central bank via the Target2 system.

- In practice, Spain owes money to Germany, and interest is paid – tax from Spain to Germany.

- The Bundesbank passes these profits to the German treasury.

- Why should this money go to the surplus country? The bigger the surplus goes to the surplus countries.

- Idea: the money goes to fight poverty and does not require a treaty change.

- The very announcement will make Europeans feel that they are part of Europe.

To solve it:

- The old system to create a national party and act is finished. It doesn’t work.

- Idea: create a pan-European level and then go to the local elections.

- There should be a program of what we want to do and that should be inclusive.

- We want to democratize Brussels.

- The idea of one person one vote is radical.

- The commission and the Eurogroup should be accountable to the parliament.

- At the current stage of degeneration, these ideas are radical.

- There are 4 time frames but we don’t need a top down party.

- I am going all around Europe to spread the word.

- Greece is important to me, but everything that happened to Greece can happen everywhere.

- People came to talk to us not because of pure solidarity but because of fear that it will happen to them.

- The party mentality is no longer useful to make a change.

- The movement should aim to be a European network open to members from different parties.

- Even the conservatives are not happy with themselves.

Immediate term:

- Full transparency

- Publication of meeting minutes

- TTIP should become transparent

Short term:

- Implementing the four policies that do not require treaty changes

Medium term:

- Creating an assembly outside Brussels where elected officials can debate

Long term:

- A new constitutions.

If we agree and we shape and it reflects public opinion across Europe, this will be spontaneous across parties across Europe.

- Q: How can you mobilize people

- A: What happens in Catalonia was what happened in Greece – feeling alone. We are missing feeling together. Your struggle for the Catalan identity is similar to Greece’s right not to be crushed and workers without rights in Germany.

- Q: How do you encounter the media?

- A: We need to get together. The nation state was invented in the 19th century. We Europeans have a lot in common. If we make this movement, the European identity will rise.

- The euro zone will break down without democracy, just like the gold standard in the 30s.

- Q: Are you frustrated?

- A: The Eurogroup is a very unpleasant place. It was 18 against one. The problem was at home, when we began surrendering. The back stabbing and the tendency to give up is what is unbearable. I believe that I did the right thing. In a sense, this is a very long war for democracy. And that was just a skirmish. Europe is more civilized than in the past.

Added 19/10:

In our latest podcast we analyze Varoufakis’ 4 problems and 4 solutions, and more

Follow us on Sticher or on iTunes