- Ethereum plummets 5.87% on a daily basis, but a recovery is underway above the 23.6% Fib level support.

- The trend is bullish and the path of least resistance is to the upside.

- ETC/USD must break the short-term resistance at $16.50 in order to curve a trajectory path towards the ultimate resistance at $20.00.

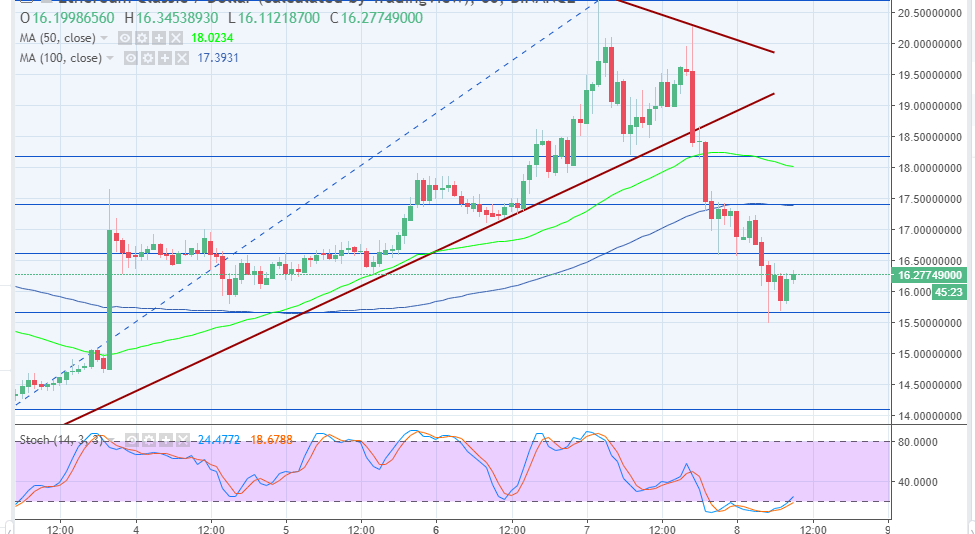

Ethereum price is among the worst hit digital assets by the selling pressure sweeping across the market on Wednesday 8. The hype due to ETC listing on Coinbase has the price trade highs at $21.11 yesterday. However, the crypto failed to support the price above $20.00. Moreover, it broke down further after breaking the contracting triangle support I explored in the previous analysis. The declines were unstoppable past the support at $18.00, in addition to that, the 100 simple moving average support on the 15-minutes timeframe chart gave in to selling pressure at $17.40.

At the time of writing, Ethereum appears to have found a support at the 23.6% Fib retracement level with the last swing high of $20.66 and a swing low of $14.106 at $15.65. The technical indicators on the chart are starting to send bullish signals, which is a welcome breather to the bulls after the extended declines.

It is important that the buyers fight for a pullback above the short-term resistance level at $16.50. Other resistance targets are at $17.23, the 100 SMA, which also aligns with the 50% Fibonacci level. Upper supply zone includes $18.42 as well as $19.57. $20.00 is the ultimate resistance zone in the medium term.

Ethereum Classic trend at the time of press is bullish. Similarly, the path of least resistance is to the upside.

ETC/USD 15-minutes chart